Summary

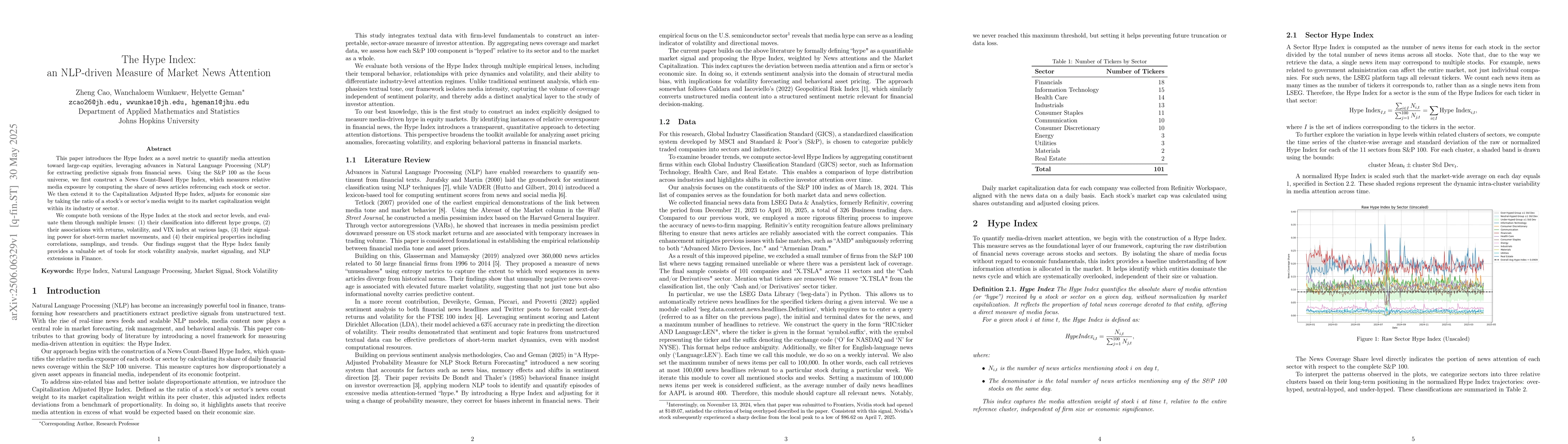

This paper introduces the Hype Index as a novel metric to quantify media attention toward large-cap equities, leveraging advances in Natural Language Processing (NLP) for extracting predictive signals from financial news. Using the S&P 100 as the focus universe, we first construct a News Count-Based Hype Index, which measures relative media exposure by computing the share of news articles referencing each stock or sector. We then extend it to the Capitalization Adjusted Hype Index, adjusts for economic size by taking the ratio of a stock's or sector's media weight to its market capitalization weight within its industry or sector. We compute both versions of the Hype Index at the stock and sector levels, and evaluate them through multiple lenses: (1) their classification into different hype groups, (2) their associations with returns, volatility, and VIX index at various lags, (3) their signaling power for short-term market movements, and (4) their empirical properties including correlations, samplings, and trends. Our findings suggest that the Hype Index family provides a valuable set of tools for stock volatility analysis, market signaling, and NLP extensions in Finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersHype-Adjusted Probability Measure for NLP Volatility Forecasting

Zheng Cao, Helyette Geman

Joint News, Attention Spillover,and Market Returns

Li Guo, Yubo Tao, Lin Peng et al.

Radar de Parit\'e: An NLP system to measure gender representation in French news stories

Maite Taboada, Valentin-Gabriel Soumah, Prashanth Rao et al.

No citations found for this paper.

Comments (0)