Summary

In this paper, we analyse the South African implied volatility in various setting. We assess the information content in SAVI implied volatility using daily markets data. Our empirical application is focused on the FTSE/JSE Top 40 index and we emphasize our models performance in distinct sub-periods. Our results are compared with VIX/VXN and S&P 500/NASDAQ 100 data in some points which are taken as our benchmark. We find a significant negative relationship between returns and volatility, in line with the results found in other markets. Finally, the link between SAVI, VIX and VXN are undertaken to examine the equity market transmission with respect to uncertainty.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

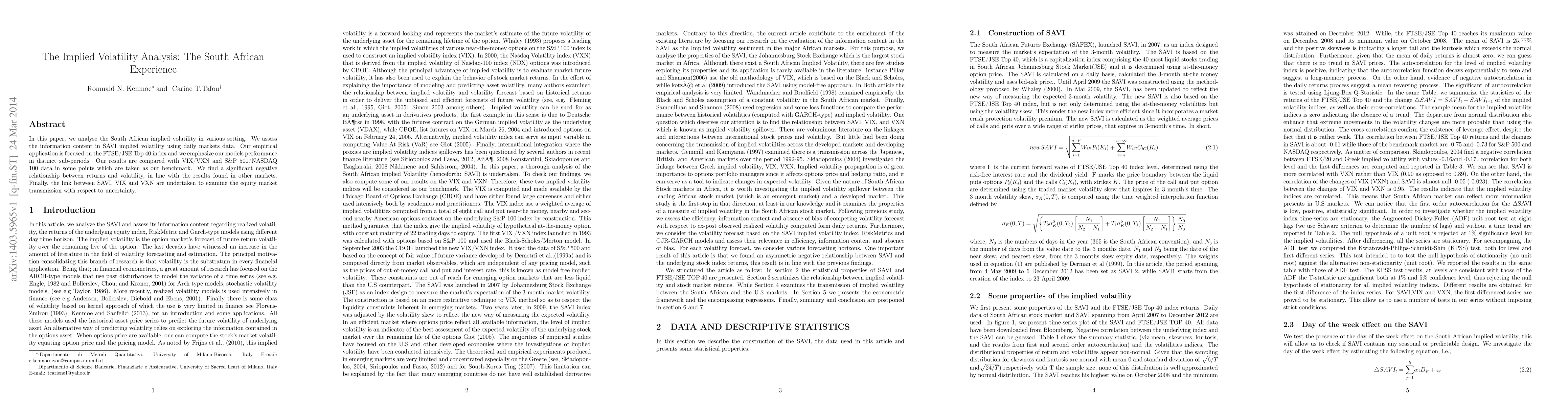

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)