Authors

Summary

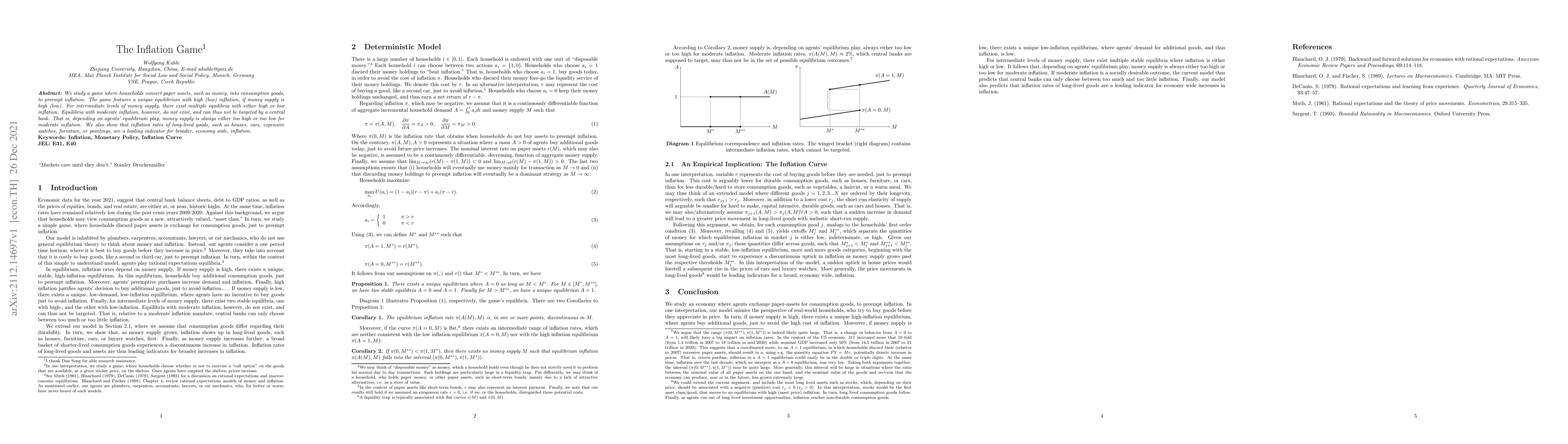

We study a game where households convert paper assets, such as money, into consumption goods, to preempt inflation. The game features a unique equilibrium with high (low) inflation, if money supply is high (low). For intermediate levels of money supply, there exist multiple equilibria with either high or low inflation. Equilibria with moderate inflation, however, do not exist, and can thus not be targeted by a central bank. That is, depending on agents' equilibrium play, money supply is always either too high or too low for moderate inflation. We also show that inflation rates of long-lived goods, such as houses, cars, expensive watches, furniture, or paintings, are a leading indicator for broader, economy wide, inflation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)