Summary

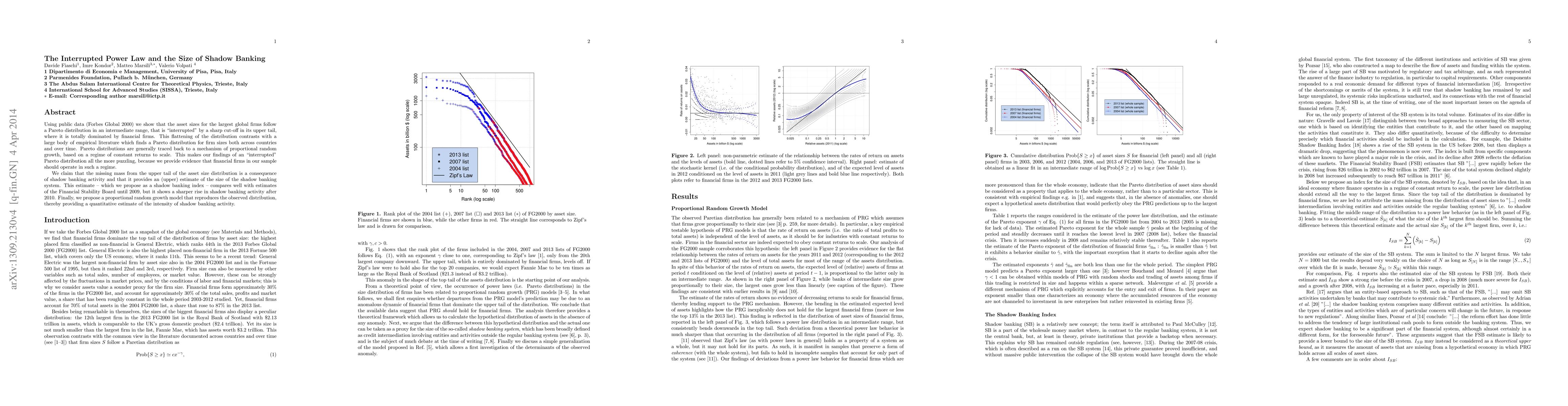

Using public data (Forbes Global 2000) we show that the asset sizes for the largest global firms follow a Pareto distribution in an intermediate range, that is ``interrupted'' by a sharp cut-off in its upper tail, where it is totally dominated by financial firms. This flattening of the distribution contrasts with a large body of empirical literature which finds a Pareto distribution for firm sizes both across countries and over time. Pareto distributions are generally traced back to a mechanism of proportional random growth, based on a regime of constant returns to scale. This makes our findings of an ``interrupted'' Pareto distribution all the more puzzling, because we provide evidence that financial firms in our sample should operate in such a regime. We claim that the missing mass from the upper tail of the asset size distribution is a consequence of shadow banking activity and that it provides an (upper) estimate of the size of the shadow banking system. This estimate -- which we propose as a shadow banking index -- compares well with estimates of the Financial Stability Board until 2009, but it shows a sharper rise in shadow banking activity after 2010. Finally, we propose a proportional random growth model that reproduces the observed distribution, thereby providing a quantitative estimate of the intensity of shadow banking activity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)