Summary

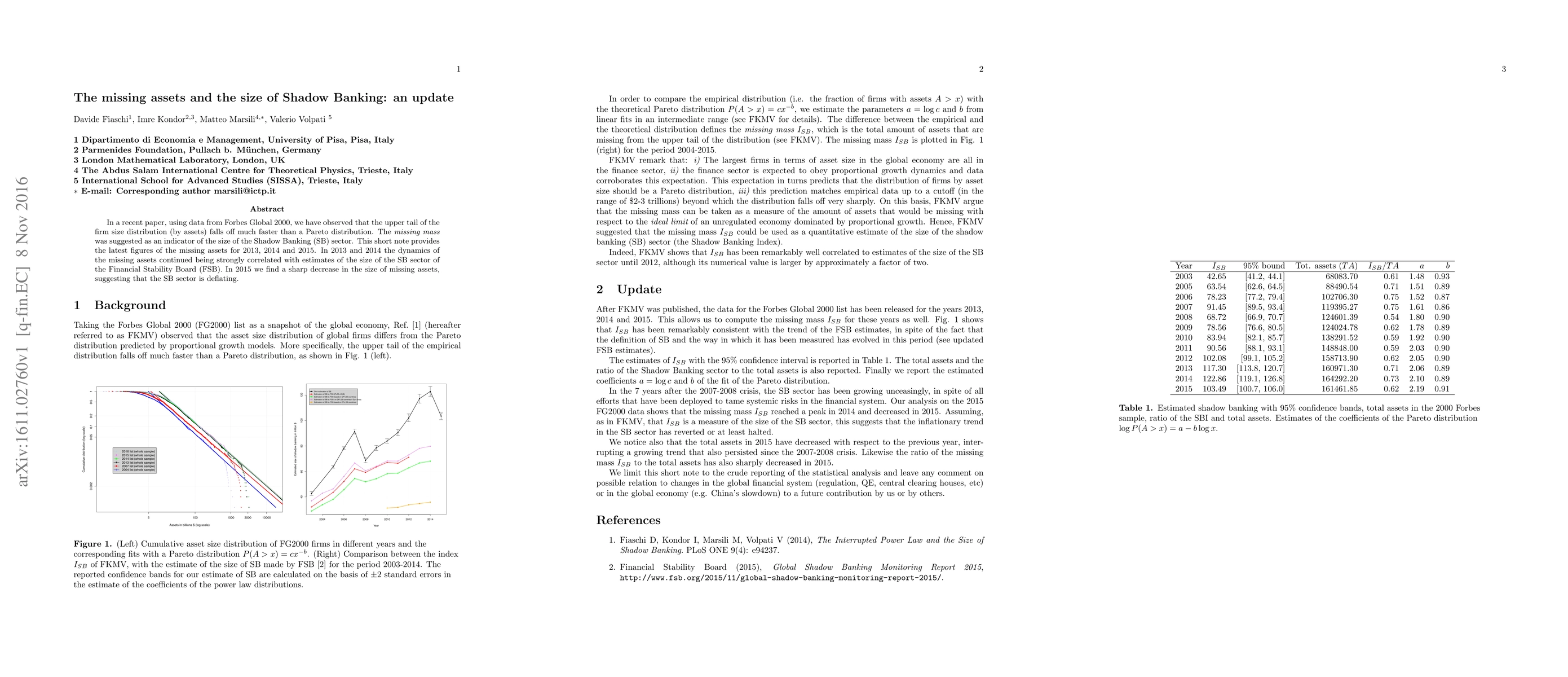

In a recent paper, using data from Forbes Global 2000, we have observed that the upper tail of the firm size distribution (by assets) falls off much faster than a Pareto distribution. The missing mass was suggested as an indicator of the size of the Shadow Banking (SB) sector. This short note provides the latest figures of the missing assets for 2013, 2014 and 2015. In 2013 and 2014 the dynamics of the missing assets continued being strongly correlated with estimates of the size of the SB sector of the Financial Stability Board. In 2015 we find a sharp decrease in the size of missing assets, suggesting that the SB sector is deflating.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)