Authors

Summary

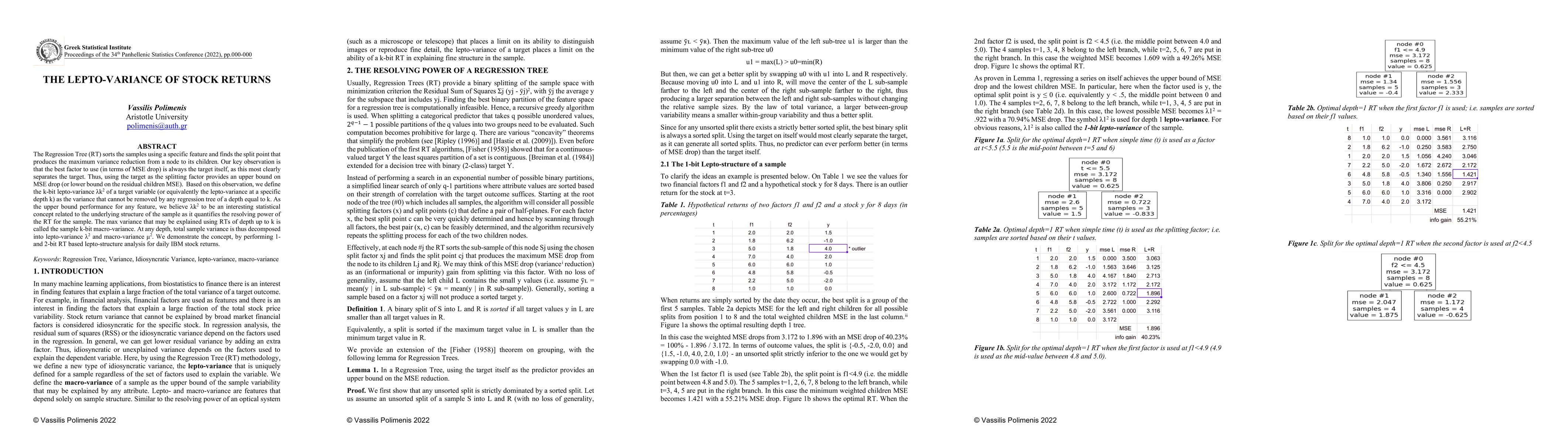

The Regression Tree (RT) sorts the samples using a specific feature and finds the split point that produces the maximum variance reduction from a node to its children. Our key observation is that the best factor to use (in terms of MSE drop) is always the target itself, as this most clearly separates the target. Thus using the target as the splitting factor provides an upper bound on MSE drop (or lower bound on the residual children MSE). Based on this observation, we define the k-bit lepto-variance ${\lambda}k^2$ of a target variable (or equivalently the lepto-variance at a specific depth k) as the variance that cannot be removed by any regression tree of a depth equal to k. As the upper bound performance for any feature, we believe ${\lambda}k^2$ to be an interesting statistical concept related to the underlying structure of the sample as it quantifies the resolving power of the RT for the sample. The max variance that may be explained using RTs of depth up to k is called the sample k-bit macro-variance. At any depth, total sample variance is thus decomposed into lepto-variance ${\lambda}^2$ and macro-variance ${\mu}^2$. We demonstrate the concept, by performing 1- and 2-bit RT based lepto-structure analysis for daily IBM stock returns.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)