Summary

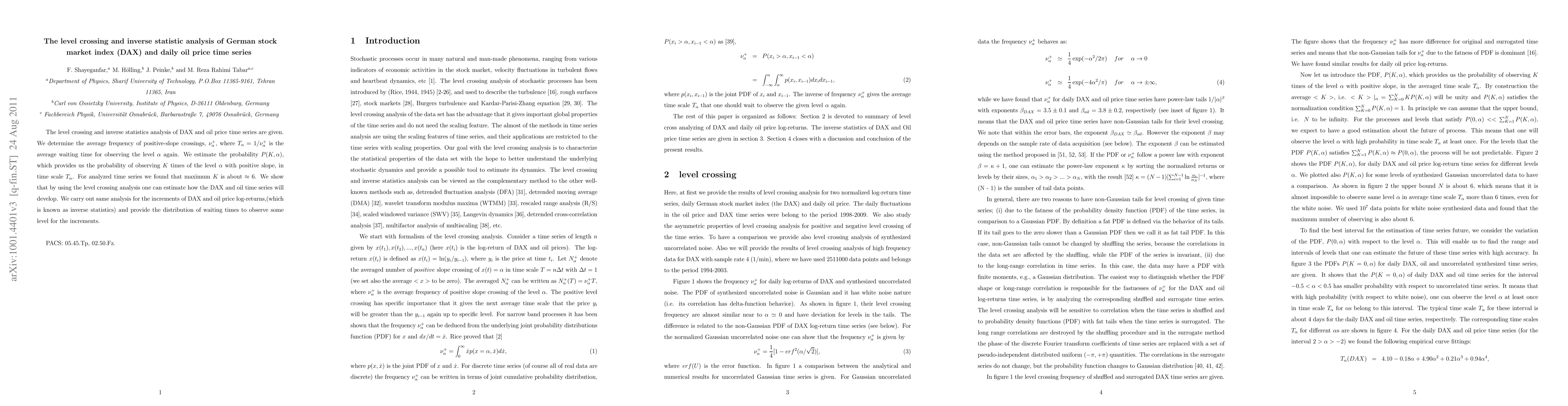

The level crossing and inverse statistics analysis of DAX and oil price time series are given. We determine the average frequency of positive-slope crossings, $\nu_{\alpha}^+$, where $T_{\alpha} =1/\nu_{\alpha}^+ $ is the average waiting time for observing the level $\alpha$ again. We estimate the probability $P(K, \alpha)$, which provides us the probability of observing $K$ times of the level $\alpha$ with positive slope, in time scale $T_{\alpha}$. For analyzed time series we found that maximum $K$ is about 6. We show that by using the level crossing analysis one can estimate how the DAX and oil time series will develop. We carry out same analysis for the increments of DAX and oil price log-returns,(which is known as inverse statistics) and provide the distribution of waiting times to observe some level for the increments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)