Summary

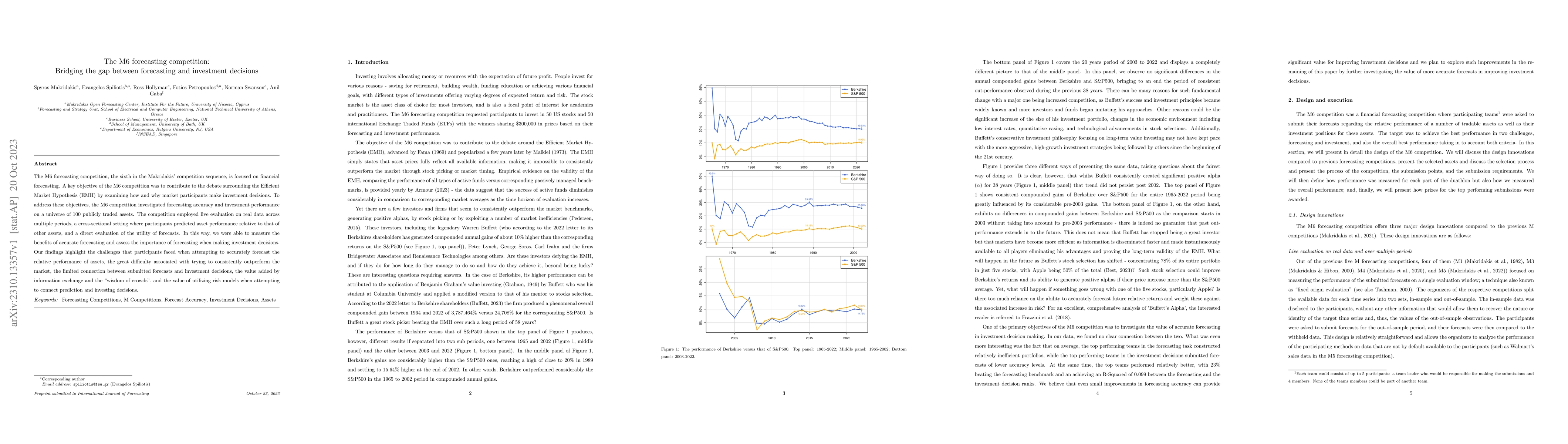

The M6 forecasting competition, the sixth in the Makridakis' competition sequence, is focused on financial forecasting. A key objective of the M6 competition was to contribute to the debate surrounding the Efficient Market Hypothesis (EMH) by examining how and why market participants make investment decisions. To address these objectives, the M6 competition investigated forecasting accuracy and investment performance on a universe of 100 publicly traded assets. The competition employed live evaluation on real data across multiple periods, a cross-sectional setting where participants predicted asset performance relative to that of other assets, and a direct evaluation of the utility of forecasts. In this way, we were able to measure the benefits of accurate forecasting and assess the importance of forecasting when making investment decisions. Our findings highlight the challenges that participants faced when attempting to accurately forecast the relative performance of assets, the great difficulty associated with trying to consistently outperform the market, the limited connection between submitted forecasts and investment decisions, the value added by information exchange and the "wisdom of crowds", and the value of utilizing risk models when attempting to connect prediction and investing decisions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn adaptive volatility method for probabilistic forecasting and its application to the M6 financial forecasting competition

Nicklas Werge, Joseph de Vilmarest

Quasi-average predictions and regression to the trend: an application the M6 financial forecasting competition

Jose M. G. Vilar

PT-Tuning: Bridging the Gap between Time Series Masked Reconstruction and Forecasting via Prompt Token Tuning

Jing Zhang, Yi Zhang, Hao Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)