Authors

Summary

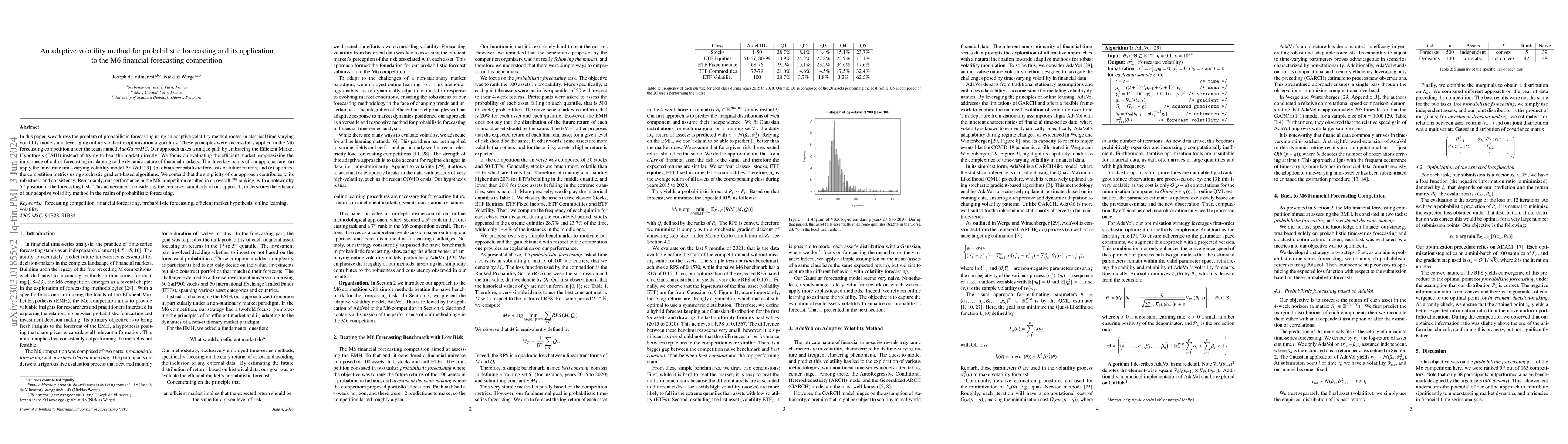

In this paper, we address the problem of probabilistic forecasting using an adaptive volatility method rooted in classical time-varying volatility models and leveraging online stochastic optimization algorithms. These principles were successfully applied in the M6 forecasting competition under the team named AdaGaussMC. Our approach takes a unique path by embracing the Efficient Market Hypothesis (EMH) instead of trying to beat the market directly. We focus on evaluating the efficient market, emphasizing the importance of online forecasting in adapting to the dynamic nature of financial markets. The three key points of our approach are: (a) apply the univariate time-varying volatility model AdaVol, (b) obtain probabilistic forecasts of future returns, and (c) optimize the competition metrics using stochastic gradient-based algorithms. We contend that the simplicity of our approach contributes to its robustness and consistency. Remarkably, our performance in the M6 competition resulted in an overall 7th ranking, with a noteworthy 5th position in the forecasting task. This achievement, considering the perceived simplicity of our approach, underscores the efficacy of our adaptive volatility method in the realm of probabilistic forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuasi-average predictions and regression to the trend: an application the M6 financial forecasting competition

Jose M. G. Vilar

The M6 forecasting competition: Bridging the gap between forecasting and investment decisions

Fotios Petropoulos, Evangelos Spiliotis, Spyros Makridakis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)