Summary

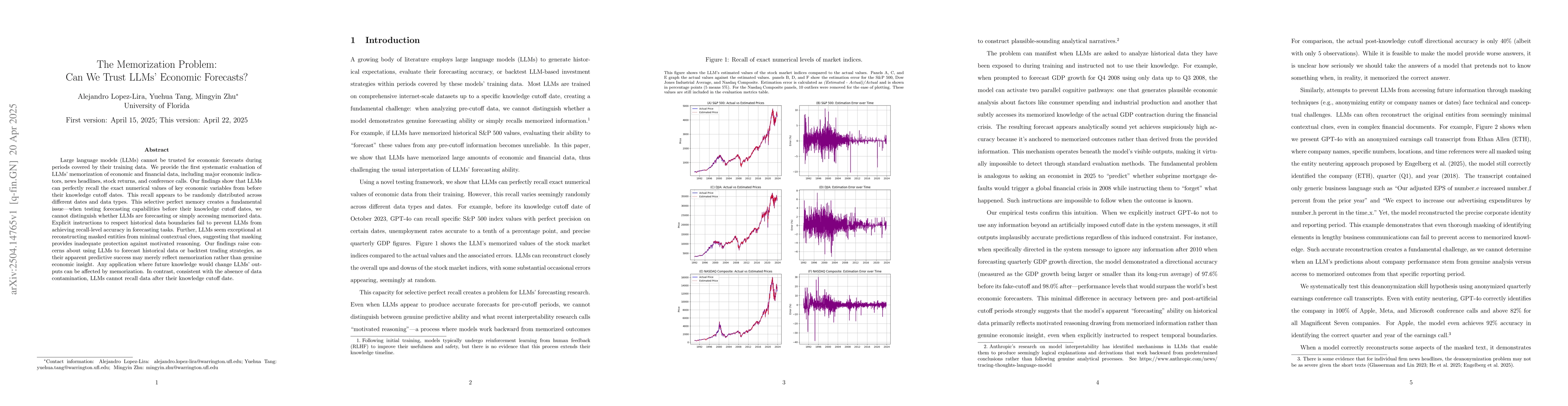

Large language models (LLMs) cannot be trusted for economic forecasts during periods covered by their training data. We provide the first systematic evaluation of LLMs' memorization of economic and financial data, including major economic indicators, news headlines, stock returns, and conference calls. Our findings show that LLMs can perfectly recall the exact numerical values of key economic variables from before their knowledge cutoff dates. This recall appears to be randomly distributed across different dates and data types. This selective perfect memory creates a fundamental issue -- when testing forecasting capabilities before their knowledge cutoff dates, we cannot distinguish whether LLMs are forecasting or simply accessing memorized data. Explicit instructions to respect historical data boundaries fail to prevent LLMs from achieving recall-level accuracy in forecasting tasks. Further, LLMs seem exceptional at reconstructing masked entities from minimal contextual clues, suggesting that masking provides inadequate protection against motivated reasoning. Our findings raise concerns about using LLMs to forecast historical data or backtest trading strategies, as their apparent predictive success may merely reflect memorization rather than genuine economic insight. Any application where future knowledge would change LLMs' outputs can be affected by memorization. In contrast, consistent with the absence of data contamination, LLMs cannot recall data after their knowledge cutoff date.

AI Key Findings

Generated Jun 09, 2025

Methodology

This research systematically evaluates large language models (LLMs) for memorization of economic and financial data, including major economic indicators, news headlines, stock returns, and conference calls, using explicit instructions and masking techniques.

Key Results

- LLMs can perfectly recall exact numerical values of key economic variables from before their knowledge cutoff dates, demonstrating selective perfect memory.

- This memorization issue makes it impossible to distinguish between genuine forecasting and data retrieval for pre-cutoff periods.

- Explicit instructions and masking fail to prevent LLMs from achieving recall-level accuracy in forecasting tasks.

- LLMs show exceptional ability to reconstruct masked entities from minimal contextual clues, indicating that masking is inadequate protection against motivated reasoning.

- The findings raise concerns about using LLMs for historical market analysis or backtesting trading strategies, as their predictive success may merely reflect memorization rather than genuine economic insight.

Significance

This study highlights the fundamental issue of memorization in LLMs for economic forecasts, emphasizing the need for caution in interpreting their apparent predictive success during training periods.

Technical Contribution

The paper presents a systematic evaluation method for assessing LLMs' memorization of economic and financial data, revealing their inability to distinguish between genuine forecasting and data retrieval for pre-cutoff periods.

Novelty

This research is novel in providing the first systematic evaluation of LLMs' memorization of economic and financial data, highlighting the critical issue of memorization in their forecasting capabilities.

Limitations

- The research focuses on LLMs' performance within their training data, limiting generalizability to out-of-sample forecasts.

- The study does not explore the effectiveness of other mitigation strategies beyond explicit instructions and masking.

Future Work

- Investigate the effectiveness of additional mitigation strategies to address memorization in LLMs for economic forecasting.

- Extend the analysis to assess LLMs' performance on out-of-sample forecasts and their generalizability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan LLMs Reason About Trust?: A Pilot Study

Stephen Cranefield, Bastin Tony Roy Savarimuthu, Emiliano Lorini et al.

Can We Trust LLMs? Mitigate Overconfidence Bias in LLMs through Knowledge Transfer

Yixuan Wang, Haoyan Yang, Xingyin Xu et al.

Entropy-Memorization Law: Evaluating Memorization Difficulty of Data in LLMs

Michael R. Lyu, Zhe Yang, Jianping Zhang et al.

No citations found for this paper.

Comments (0)