Authors

Summary

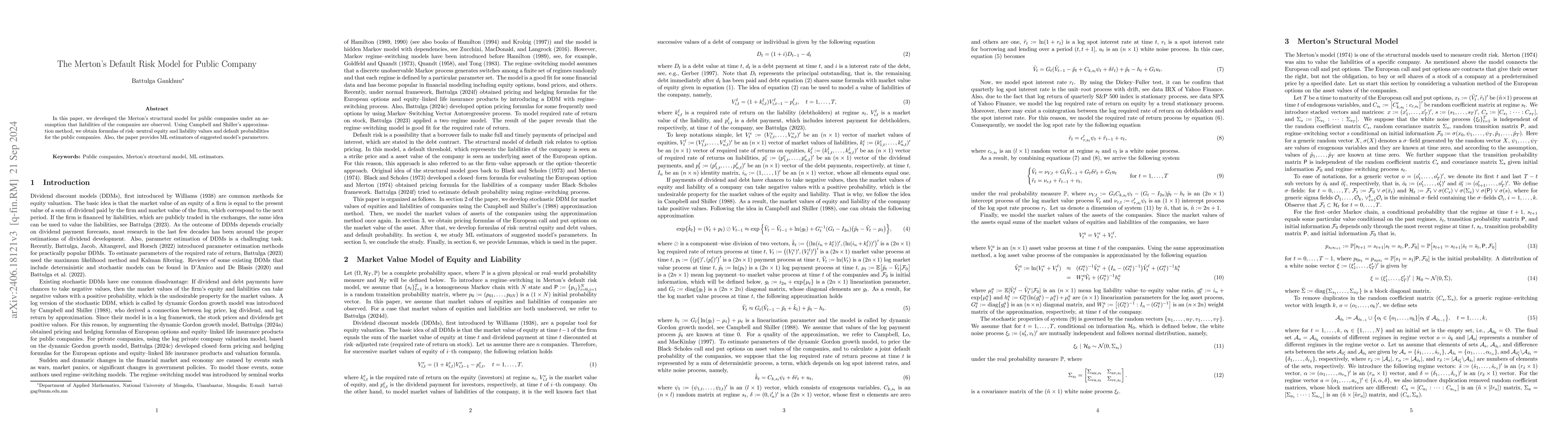

In this paper, we developed the Merton's structural model for public companies under an assumption that liabilities of the companies are observed. Using Campbell and Shiller's approximation method, we obtain formulas of risk-neutral equity and liability values and default probabilities for the public companies. Also, the paper provides ML estimators of suggested model's parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe financial health of a company and the risk of its default: Back to the future

Gianmarco Bet, Francesco Dainelli, Eugenio Fabrizi

No citations found for this paper.

Comments (0)