Summary

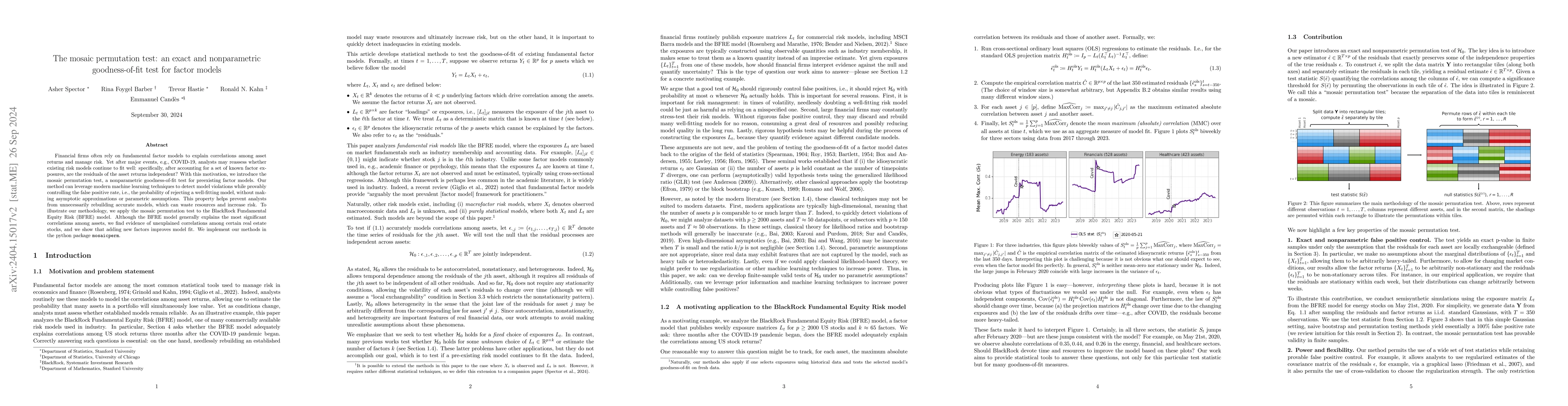

Financial firms often rely on factor models to explain correlations among asset returns. These models are important for managing risk, for example by modeling the probability that many assets will simultaneously lose value. Yet after major events, e.g., COVID-19, analysts may reassess whether existing models continue to fit well: specifically, after accounting for the factor exposures, are the residuals of the asset returns independent? With this motivation, we introduce the mosaic permutation test, a nonparametric goodness-of-fit test for preexisting factor models. Our method allows analysts to use nearly any machine learning technique to detect model violations while provably controlling the false positive rate, i.e., the probability of rejecting a well-fitting model. Notably, this result does not rely on asymptotic approximations and makes no parametric assumptions. This property helps prevent analysts from unnecessarily rebuilding accurate models, which can waste resources and increase risk. We illustrate our methodology by applying it to the Blackrock Fundamental Equity Risk (BFRE) model. Using the mosaic permutation test, we find that the BFRE model generally explains the most significant correlations among assets. However, we find evidence of unexplained correlations among certain real estate stocks, and we show that adding new factors improves model fit. We implement our methods in the python package mosaicperm.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper introduces the mosaic permutation test, a nonparametric goodness-of-fit test for factor models, which does not rely on asymptotic approximations or parametric assumptions. It allows analysts to use machine learning techniques to detect model violations while controlling the false positive rate.

Key Results

- The mosaic permutation test was applied to the BlackRock Fundamental Equity Risk (BFRE) model, finding that it generally explains the most significant correlations among assets.

- Evidence of unexplained correlations among certain real estate stocks was discovered, suggesting the need for additional factors to improve model fit.

- The method was shown to be effective in diagnosing financial factor models and can be applied to test the goodness-of-fit of factor models in various domains.

Significance

This research is important as it provides a robust, exact, and nonparametric test for factor models, helping financial firms manage risk more accurately. It prevents unnecessary model rebuilding, saving resources and reducing risk.

Technical Contribution

The paper presents the mosaic permutation test, an exact and nonparametric goodness-of-fit test for factor models with known exposures, which controls the false positive rate without relying on asymptotic approximations or parametric assumptions.

Novelty

The mosaic permutation test stands out for its exactness, nonparametric nature, and ability to adapt to various test statistics, making it a flexible and powerful tool for diagnosing factor models in finance and other domains.

Limitations

- The method assumes known exposures in factor models and does not directly address cases where factor returns are known.

- The analysis relies on the validity of Assumptions 3.1-3.2, which may not hold in all real-world scenarios.

Future Work

- Extending the mosaic permutation test to handle factor models with known factor returns.

- Developing methods that can utilize regularization to increase power.

- Investigating the robustness of the test to small inaccuracies in exposure estimates.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)