Summary

We study optimal reinsurance in the framework of stochastic game theory, in which there is an insurer and two reinsurers. A Stackelberg model is established to analyze the non-cooperative relationship between the insurer and reinsurers, where the insurer is considered as the follower and the reinsurers are considered as the leaders. The insurer is a price taker who determines reinsurance demand in the reinsurance market, while the reinsurers can price the reinsurance treaties. Our contribution is to use a Nash game to describe the price-competition between two reinsurers. We assume that one of the reinsurers adopts the variance premium principle and the other adopts the expected value premium principle. The insurer and the reinsurers aim to maximize their respective mean-variance cost functions which lead to a time-inconsistency control problem. To overcome the time-inconsistency issue in the game, we formulate the optimization problem of each player as an embedded game and solve it via a corresponding extended Hamilton-Jacobi-Bellman equation. We find that the insurer will sign propositional and excess loss reinsurance strategies with reinsurer 1 and reinsurer 2, respectively. When the claim size follows exponential distribution, there exists a unique equilibrium reinsurance premium strategy. Our numerical analysis verifies the impact of claim size, risk aversion and interest rates of the insurer and reinsurers on equilibrium reinsurance strategy and premium strategy, which can help to understand competition in the reinsurance market

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

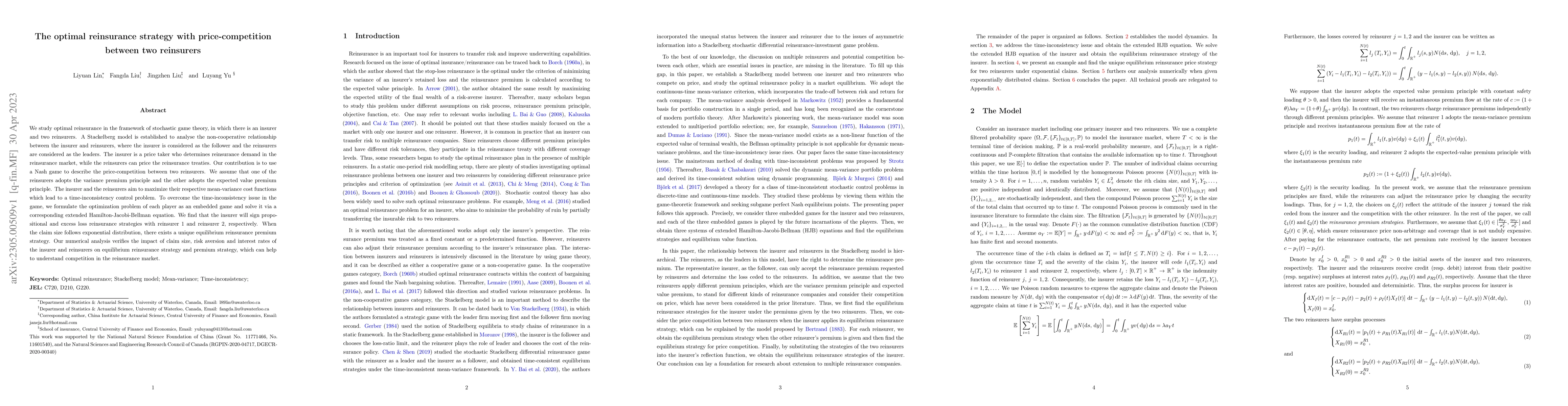

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Two-layer Stochastic Game Approach to Reinsurance Contracting and Competition

Yi Xia, Zongxia Liang, Bin Zou

A dynamic optimal reinsurance strategy with capital injections in the Cramer-Lundberg model

Asma Khedher, Zakaria Aljaberi, Mohamed Mnif

| Title | Authors | Year | Actions |

|---|

Comments (0)