Authors

Summary

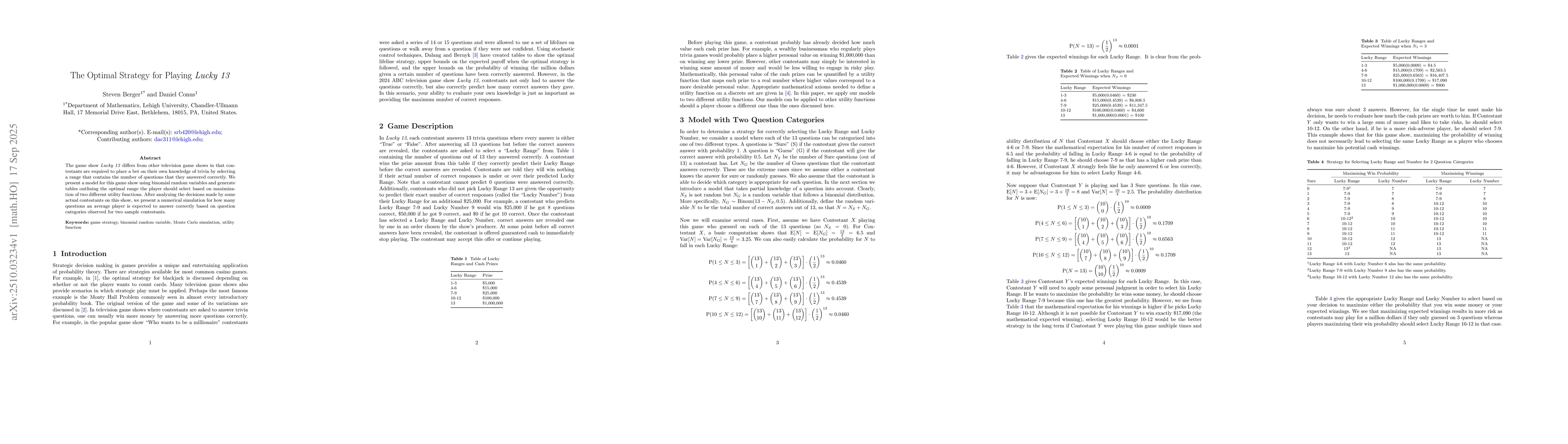

The game show Lucky 13 differs from other television game shows in that contestants are required to place a bet on their own knowledge of trivia by selecting a range that contains the number of questions that they answered correctly. We present a model for this game show using binomial random variables and generate tables outlining the optimal range the player should select based on maximization of two different utility functions. After analyzing the decisions made by some actual contestants on this show, we present a numerical simulation for how many questions an average player is expected to answer correctly based on question categories observed for two sample contestants.

AI Key Findings

Generated Oct 12, 2025

Methodology

The research employs a combination of binomial probability models, utility function analysis, and Monte Carlo simulations to determine optimal strategies for the game show Lucky 13. It also includes case studies of actual contestants and simulations of average player performance.

Key Results

- Contestant Z should select Lucky Range 10-12 and Lucky Number 12 to maximize expected winnings, with a 71.88% chance of winning $100,000 and a 28.13% chance of winning $1,000,000.

- Contestant B's optimal strategy was to select Lucky Range 10-12 and Lucky Number 11, with a 63% chance of hitting the range and 24% chance of hitting the number before any answers were revealed.

- The model predicts that an average player will answer between 6-8 questions correctly, suggesting that contestants should focus on ranges within this expected range for optimal strategy.

Significance

This research provides actionable strategies for contestants in Lucky 13 by combining probability theory and utility maximization, offering insights into risk tolerance and decision-making under uncertainty in game shows.

Technical Contribution

The paper introduces a binomial-based model for Lucky 13 that incorporates multiple question categories (Sure, Unsure, Guess) and utility functions to optimize both probability of winning and expected winnings.

Novelty

This work is novel in its application of risk tolerance analysis and utility functions to a game show context, along with the integration of Monte Carlo simulations and case studies to validate theoretical models.

Limitations

- The study relies on subjective judgment for categorizing questions and estimating player expertise, which may introduce bias.

- The Monte Carlo simulations assume uniform probabilities for question categories, which may not reflect real-world variability.

Future Work

- Conduct empirical studies to validate the optimal strategies against real contestant behavior.

- Develop models to determine the optimal quitting points for contestants based on show offers.

- Investigate the impact of different question category distributions on player performance.

Paper Details

PDF Preview

Similar Papers

Found 5 papersSub-optimal Approaches to Heteroscedasticity in Silicon Strip Detectors: the Lucky Model and the Super-Lucky Model

Gregorio Landi, Giovanni E. Landi

Lucky cars and lucky spots in parking functions

Steve Butler, Kimberly Hadaway, Victoria Lenius et al.

Comments (0)