Authors

Summary

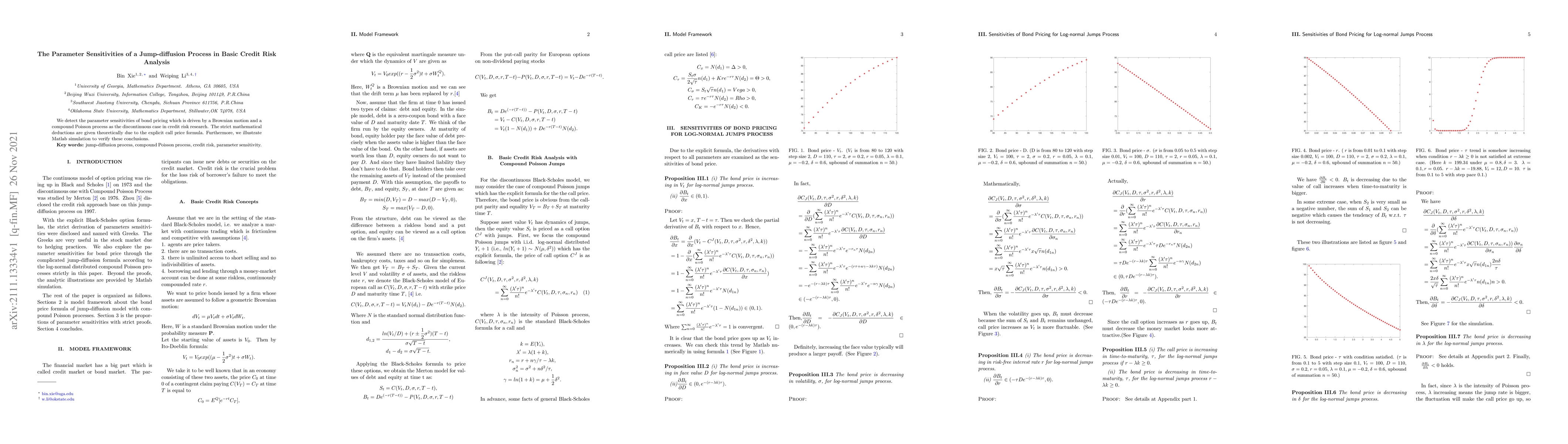

We detect the parameter sensitivities of bond pricing which is driven by a Brownian motion and a compound Poisson process as the discontinuous case in credit risk research. The strict mathematical deductions are given theoretically due to the explicit call price formula. Furthermore, we illustrate Matlab simulation to verify these conclusions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing Transition Risk with a Jump-Diffusion Credit Risk Model: Evidences from the CDS market

Giulia Livieri, Davide Radi, Elia Smaniotto

A contagion process with self-exciting jumps in credit risk applications

Puneet Pasricha, Dharmaraja Selvamuthu, Selvaraju Natarajan

No citations found for this paper.

Comments (0)