Authors

Summary

Automated Market Makers (AMMs) are a class of smart contracts on Ethereum and other blockchains that "make markets" autonomously. In other words, AMMs stand ready to trade with other market participants that interact with them, at the conditions determined by the AMM. In this this paper, which relies on the existing and growing corpus of literature available, we review and present the key mathematical and quantitative finance aspects that underpin their operations, including the interesting relationship between AMMs and derivatives pricing and hedging.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

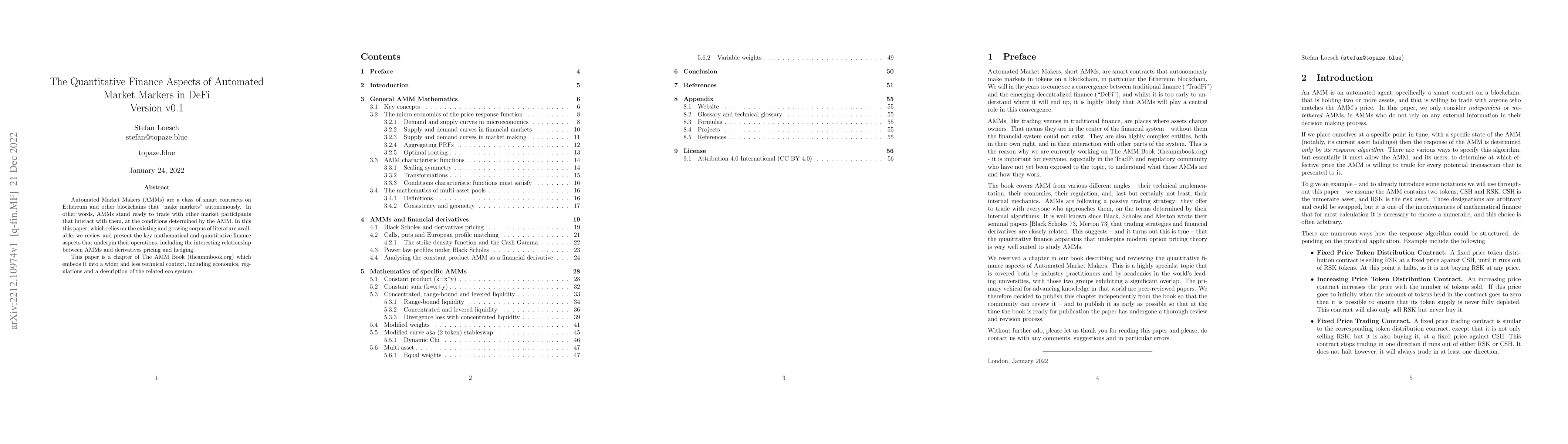

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Misconduct in Decentralized Finance (DeFi): Analysis, Regulatory Challenges and Policy Implications

Xihan Xiong, Zhipeng Wang, William Knottenbelt et al.

A theory of Automated Market Makers in DeFi

Massimo Bartoletti, James Hsin-yu Chiang, Alberto Lluch-Lafuente

SoK: Decentralized Finance (DeFi)

William J. Knottenbelt, Ariah Klages-Mundt, Lewis Gudgeon et al.

No citations found for this paper.

Comments (0)