Summary

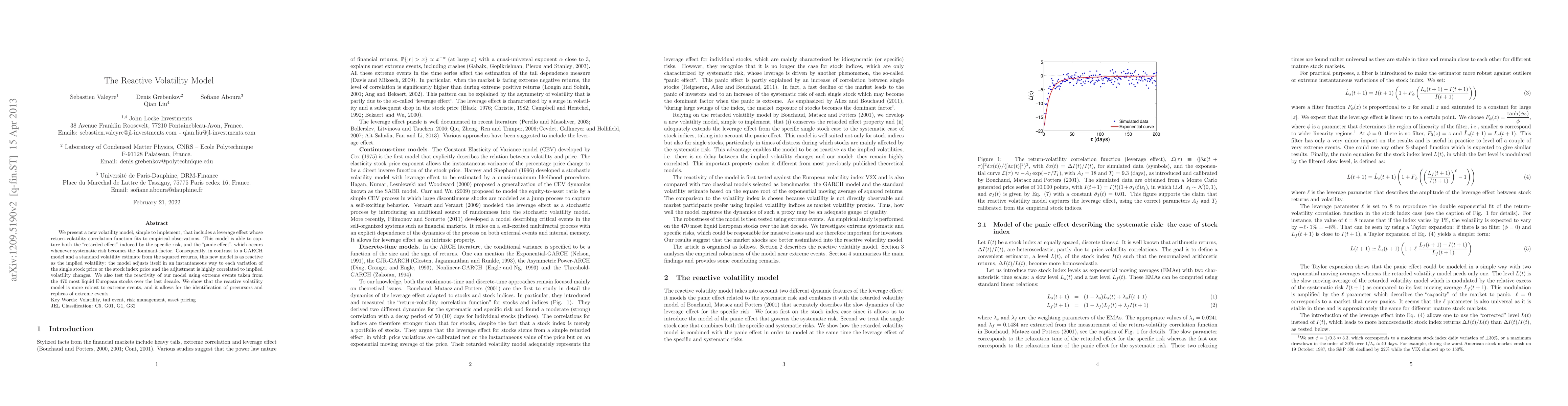

We present a new volatility model, simple to implement, that includes a leverage effect whose return-volatility correlation function fits to empirical observations. This model is able to capture both the "retarded effect" induced by the specific risk, and the "panic effect", which occurs whenever systematic risk becomes the dominant factor. Consequently, in contrast to a GARCH model and a standard volatility estimate from the squared returns, this new model is as reactive as the implied volatility: the model adjusts itself in an instantaneous way to each variation of the single stock price or the stock index price and the adjustment is highly correlated to implied volatility changes. We also test the reactivity of our model using extreme events taken from the 470 most liquid European stocks over the last decade. We show that the reactive volatility model is more robust to extreme events, and it allows for the identification of precursors and replicas of extreme events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom Reactive to Proactive Volatility Modeling with Hemisphere Neural Networks

Philippe Goulet Coulombe, Mikael Frenette, Karin Klieber

| Title | Authors | Year | Actions |

|---|

Comments (0)