Summary

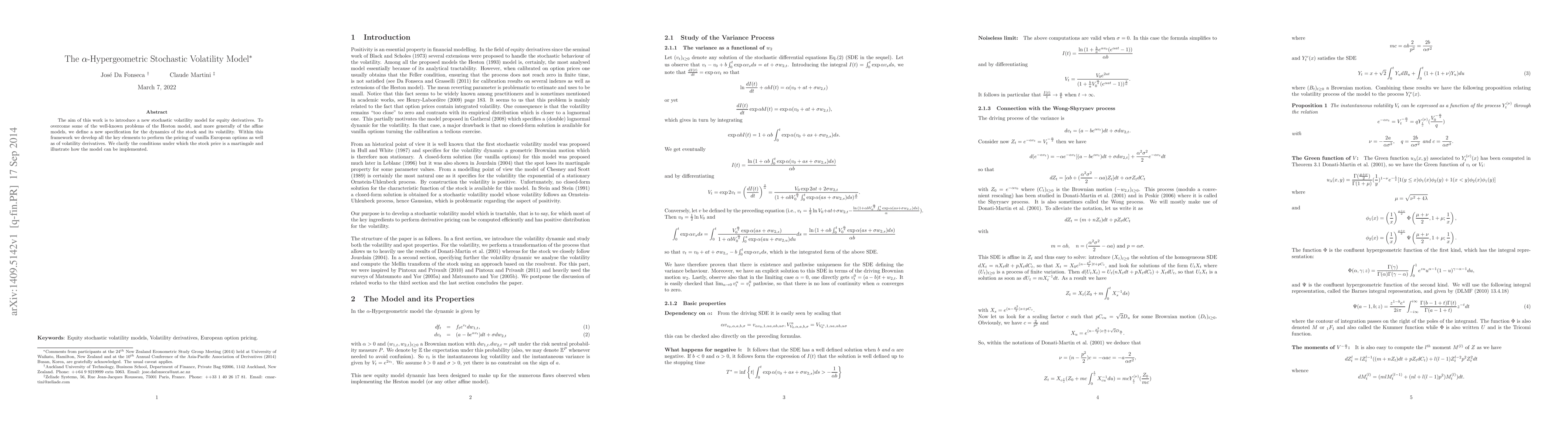

The aim of this work is to introduce a new stochastic volatility model for equity derivatives. To overcome some of the well-known problems of the Heston model, and more generally of the affine models, we define a new specification for the dynamics of the stock and its volatility. Within this framework we develop all the key elements to perform the pricing of vanilla European options as well as of volatility derivatives. We clarify the conditions under which the stock price is a martingale and illustrate how the model can be implemented.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)