Authors

Summary

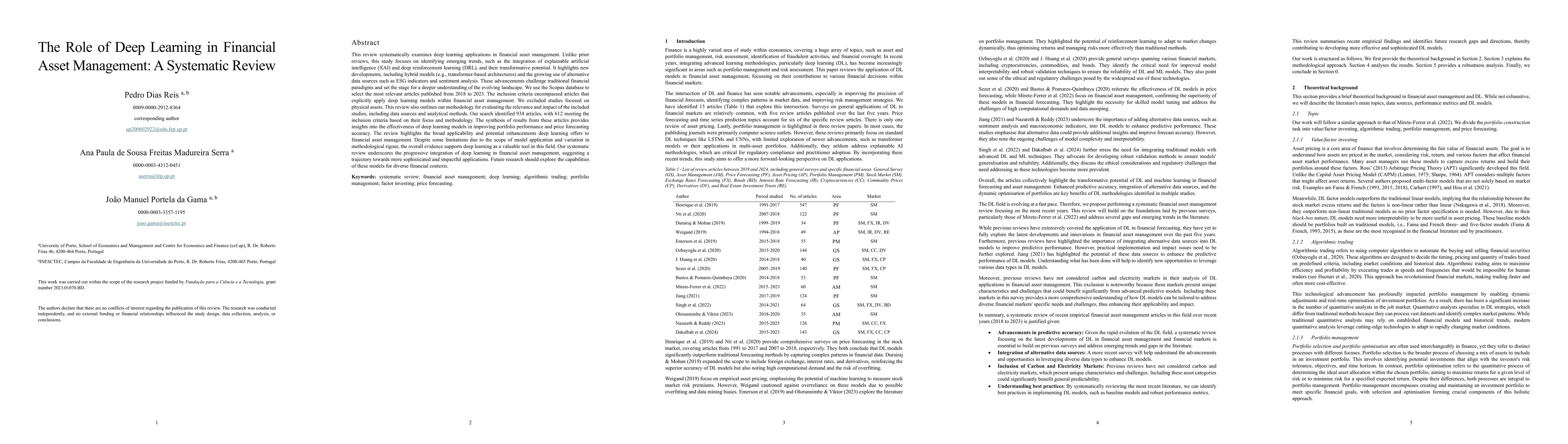

This review systematically examines deep learning applications in financial asset management. Unlike prior reviews, this study focuses on identifying emerging trends, such as the integration of explainable artificial intelligence (XAI) and deep reinforcement learning (DRL), and their transformative potential. It highlights new developments, including hybrid models (e.g., transformer-based architectures) and the growing use of alternative data sources such as ESG indicators and sentiment analysis. These advancements challenge traditional financial paradigms and set the stage for a deeper understanding of the evolving landscape. We use the Scopus database to select the most relevant articles published from 2018 to 2023. The inclusion criteria encompassed articles that explicitly apply deep learning models within financial asset management. We excluded studies focused on physical assets. This review also outlines our methodology for evaluating the relevance and impact of the included studies, including data sources and analytical methods. Our search identified 934 articles, with 612 meeting the inclusion criteria based on their focus and methodology. The synthesis of results from these articles provides insights into the effectiveness of deep learning models in improving portfolio performance and price forecasting accuracy. The review highlights the broad applicability and potential enhancements deep learning offers to financial asset management. Despite some limitations due to the scope of model application and variation in methodological rigour, the overall evidence supports deep learning as a valuable tool in this field. Our systematic review underscores the progressive integration of deep learning in financial asset management, suggesting a trajectory towards more sophisticated and impactful applications.

AI Key Findings

Generated Jun 10, 2025

Methodology

This systematic review examines deep learning applications in financial asset management using the Scopus database, focusing on articles from 2018 to 2023. It identifies emerging trends like explainable AI (XAI) and deep reinforcement learning (DRL), and evaluates the relevance and impact of included studies based on data sources and analytical methods.

Key Results

- Deep learning models have been increasingly applied in financial asset management, with price forecasting being the predominant topic.

- Hybrid models, such as transformer-based architectures, and the use of alternative data sources like ESG indicators and sentiment analysis are on the rise.

- Deep learning models, especially LSTMs, ANNs, and CNNs, show superior performance in various financial tasks compared to traditional methods.

- The integration of explainable AI in asset pricing models enhances accuracy by reducing dimensionality and capturing complex non-linear relationships.

- DRL models, particularly DQN, are widely used in algorithmic trading for decision-making in buying, holding, or selling financial assets.

Significance

This research highlights the transformative potential of deep learning in financial asset management, challenging traditional paradigms and offering insights into improving portfolio performance and price forecasting accuracy.

Technical Contribution

The review synthesizes findings from 612 articles, showcasing the effectiveness of deep learning models in financial asset management tasks, including value/factor investing, algorithmic trading, portfolio management, and price forecasting.

Novelty

This systematic review distinguishes itself by focusing on emerging trends, such as XAI and DRL, and analyzing their transformative potential in financial asset management, setting the stage for more sophisticated applications.

Limitations

- Some limitations exist due to the scope of model application and variation in methodological rigour among studies.

- The review focuses on articles published in computer science journals, potentially missing relevant work in finance-specific outlets.

Future Work

- Future research should implement recent advances in computer science, such as attention mechanisms and GNNs, across all topics in financial asset management.

- Expanding studies to include multiple asset types and diverse markets will enhance model reliability and applicability in various financial situations.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersYear-over-Year Developments in Financial Fraud Detection via Deep Learning: A Systematic Literature Review

Yixin Xu, Chuqing Zhao, Yisong Chen et al.

Contrastive Learning of Asset Embeddings from Financial Time Series

Rian Dolphin, Barry Smyth, Ruihai Dong

| Title | Authors | Year | Actions |

|---|

Comments (0)