Summary

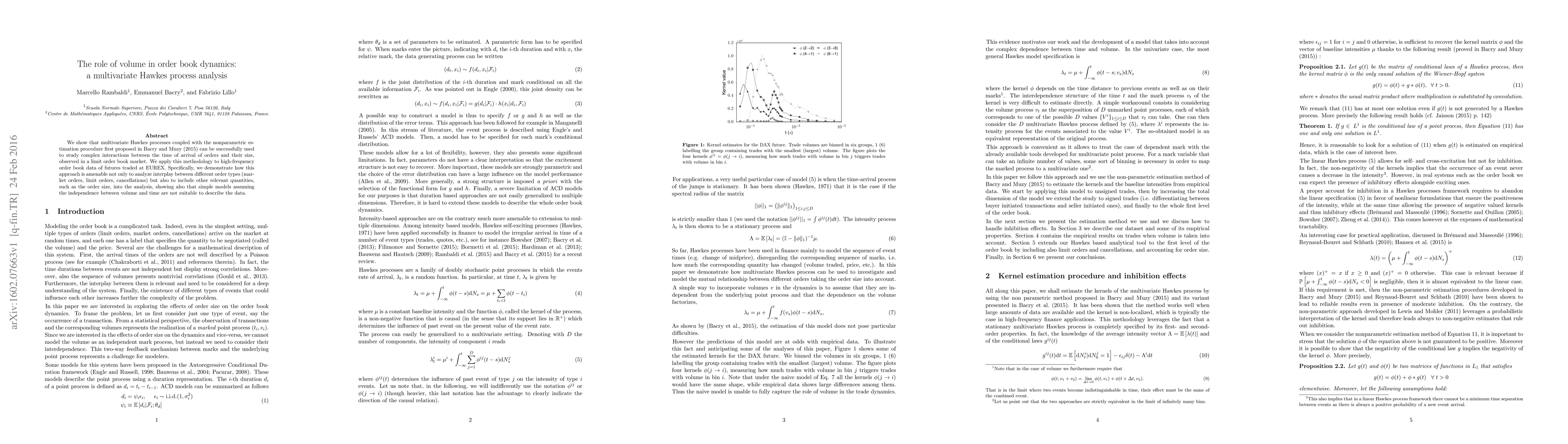

We show that multivariate Hawkes processes coupled with the nonparametric estimation procedure first proposed in Bacry and Muzy (2015) can be successfully used to study complex interactions between the time of arrival of orders and their size, observed in a limit order book market. We apply this methodology to high-frequency order book data of futures traded at EUREX. Specifically, we demonstrate how this approach is amenable not only to analyze interplay between different order types (market orders, limit orders, cancellations) but also to include other relevant quantities, such as the order size, into the analysis, showing also that simple models assuming the independence between volume and time are not suitable to describe the data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLimit Order Book Dynamics and Order Size Modelling Using Compound Hawkes Process

Philip Treleaven, Konark Jain, Nick Firoozye et al.

Order Book Queue Hawkes-Markovian Modeling

Shihao Yang, Philip Protter, Qianfan Wu

| Title | Authors | Year | Actions |

|---|

Comments (0)