Authors

Summary

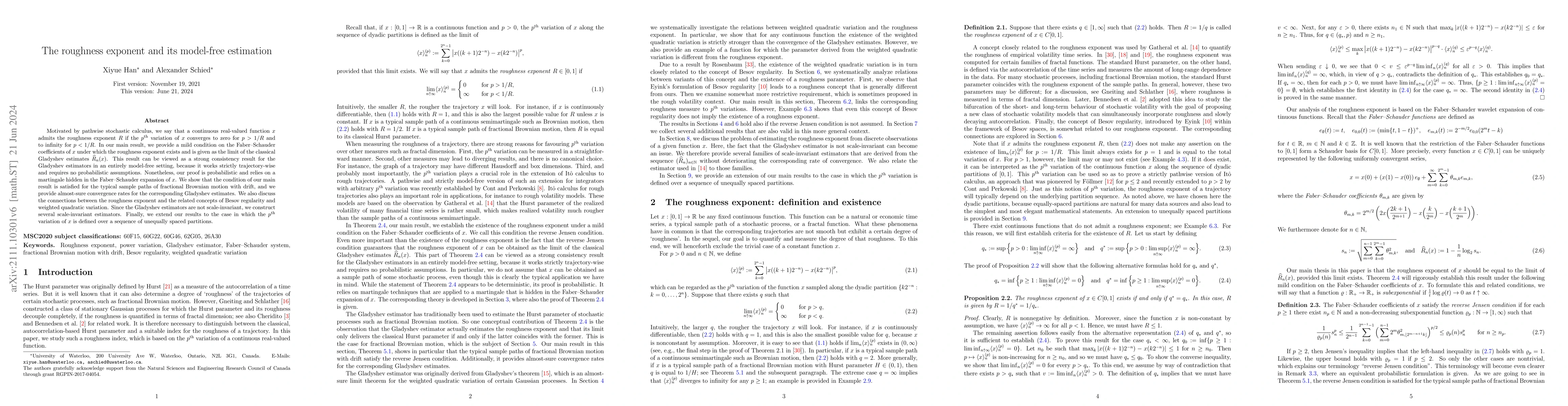

Motivated by pathwise stochastic calculus, we say that a continuous real-valued function $x$ admits the roughness exponent $R$ if the $p^{\text{th}}$ variation of $x$ converges to zero if $p>1/R$ and to infinity if $p<1/R$. For the sample paths of many stochastic processes, such as fractional Brownian motion, the roughness exponent exists and equals the standard Hurst parameter. In our main result, we provide a mild condition on the Faber--Schauder coefficients of $x$ under which the roughness exponent exists and is given as the limit of the classical Gladyshev estimates $\widehat R_n(x)$. This result can be viewed as a strong consistency result for the Gladyshev estimators in an entirely model-free setting, because it works strictly trajectory-wise and requires no probabilistic assumptions. Nonetheless, our proof is probabilistic and relies on a martingale that is hidden in the Faber--Schauder expansion of $x$. Since the Gladyshev estimators are not scale-invariant, we construct several scale-invariant estimators that are derived from the sequence $(\widehat R_n)_{n\in\mathbb N}$. We also discuss how a dynamic change in the roughness parameter of a time series can be detected. Finally, we extend our results to the case in which the $p^{\text{th}}$ variation of $x$ is defined over a sequence of unequally spaced partitions. Our results are illustrated by means of high-frequency financial time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)