Summary

We find that when measured in terms of dollar-turnover, and once $\beta$-neutralised and Low-Vol neutralised, the Size Effect is alive and well. With a long term t-stat of $5.1$, the "Cold-Minus-Hot" (CMH) anomaly is certainly not less significant than other well-known factors such as Value or Quality. As compared to market-cap based SMB, CMH portfolios are much less anti-correlated to the Low-Vol anomaly. In contrast with standard risk premia, size-based portfolios are found to be virtually unskewed. In fact, the extreme risk of these portfolios is dominated by the large cap leg; small caps actually have a positive (rather than negative) skewness. The only argument that favours a risk premium interpretation at the individual stock level is that the extreme drawdowns are more frequent for small cap/turnover stocks, even after accounting for volatility. This idiosyncratic risk is however clearly diversifiable.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

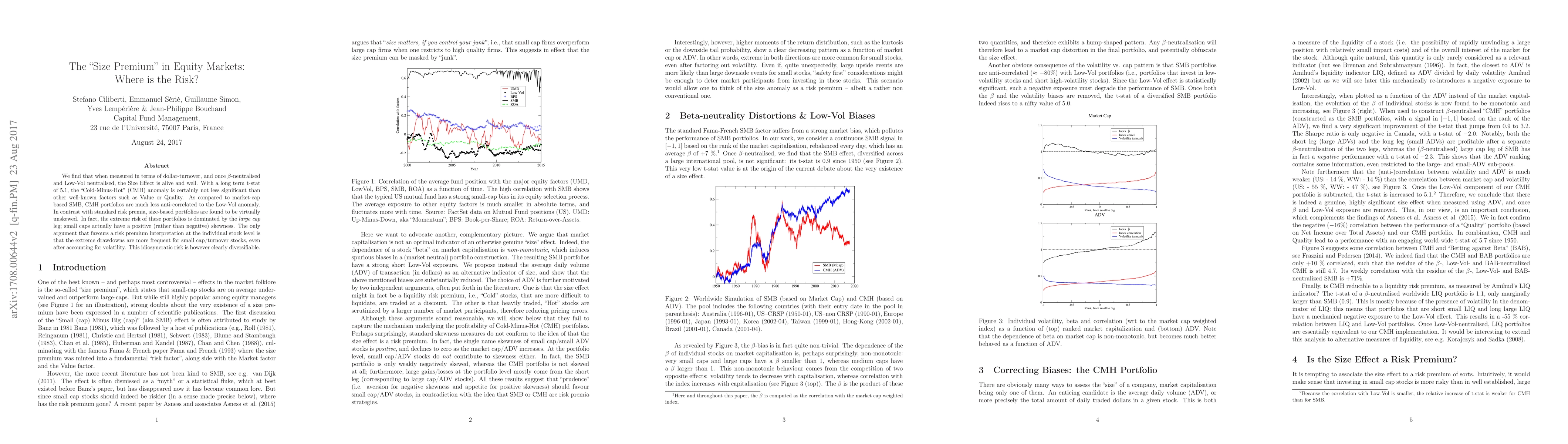

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)