Authors

Summary

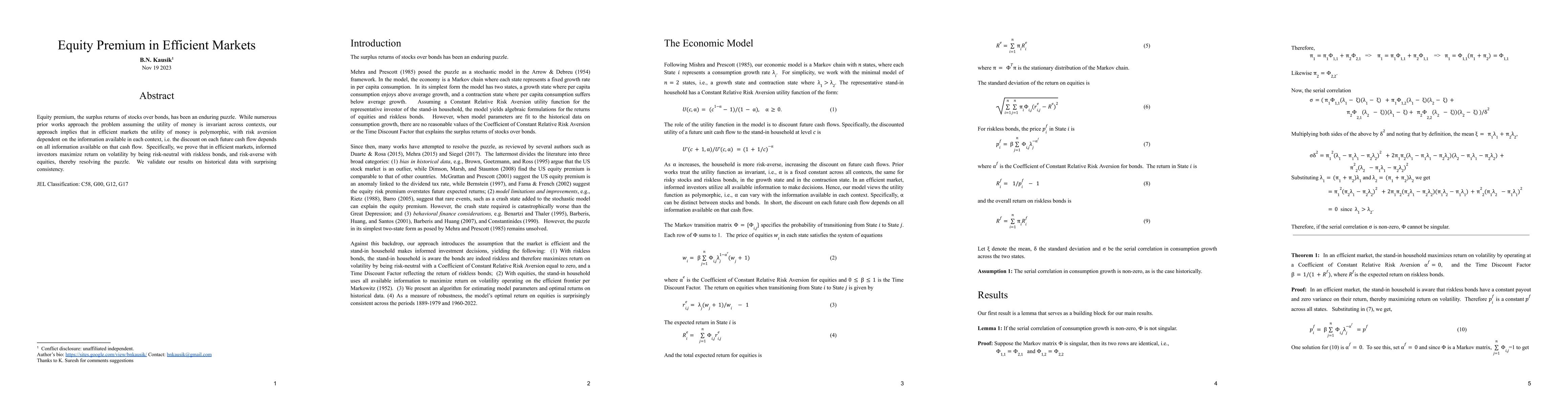

Equity premium, the surplus returns of stocks over bonds, has been an enduring puzzle. While numerous prior works approach the problem assuming the utility of money is invariant across contexts, our approach implies that in efficient markets the utility of money is polymorphic, with risk aversion dependent on the information available in each context, i.e. the discount on each future cash flow depends on all information available on that cash flow. Specifically, we prove that in efficient markets, informed investors maximize return on volatility by being risk-neutral with riskless bonds, and risk-averse with equities, thereby resolving the puzzle. We validate our results on historical data with surprising consistency. JEL Classification: C58, G00, G12, G17

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)