Summary

Large language models (LLMs) have emerged as powerful tools in the field of finance, particularly for risk management across different asset classes. In this work, we introduce a Cross-Asset Risk Management framework that utilizes LLMs to facilitate real-time monitoring of equity, fixed income, and currency markets. This innovative approach enables dynamic risk assessment by aggregating diverse data sources, ultimately enhancing decision-making processes. Our model effectively synthesizes and analyzes market signals to identify potential risks and opportunities while providing a holistic view of asset classes. By employing advanced analytics, we leverage LLMs to interpret financial texts, news articles, and market reports, ensuring that risks are contextualized within broader market narratives. Extensive backtesting and real-time simulations validate the framework, showing increased accuracy in predicting market shifts compared to conventional methods. The focus on real-time data integration enhances responsiveness, allowing financial institutions to manage risks adeptly under varying market conditions and promoting financial stability through the advanced application of LLMs in risk analysis.

AI Key Findings

Generated Jun 10, 2025

Methodology

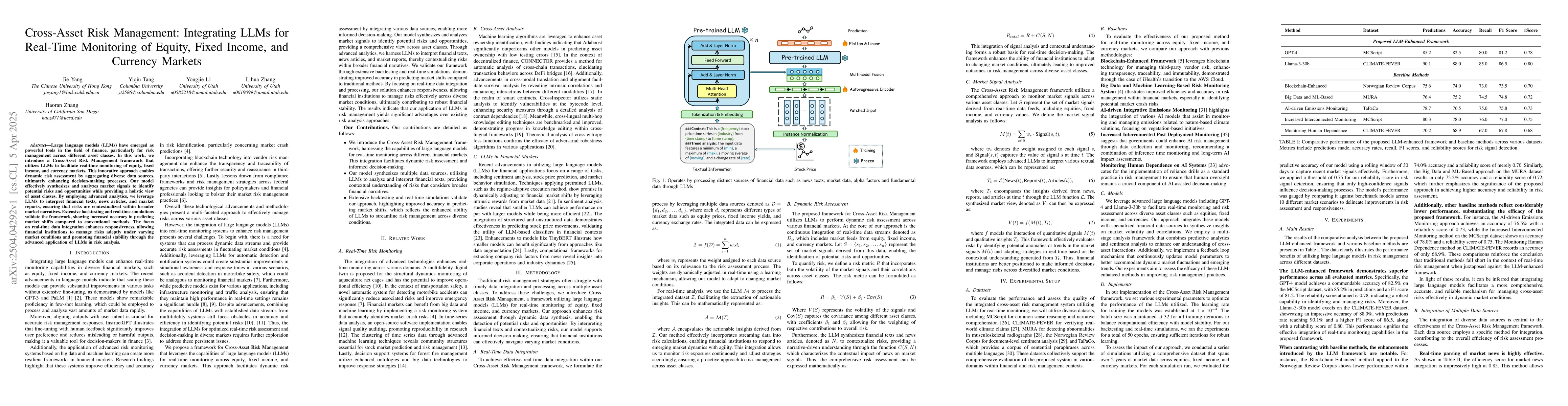

The research introduces a Cross-Asset Risk Management framework that utilizes Large Language Models (LLMs) for real-time monitoring of equity, fixed income, and currency markets. It integrates diverse data sources, including financial texts, news articles, market reports, equity prices, fixed income yields, and currency exchange rates, to dynamically assess risks and opportunities.

Key Results

- The LLM-enhanced framework demonstrates superior performance across various datasets, outperforming baseline methods in accuracy, recall, F1-score, and reliability.

- GPT-4 achieves an accuracy of 82.5% on the MCScript dataset, with an F1-score of 81.2, showcasing robust risk identification and management capabilities.

- Llama-3-30b excels on the CLIMATE-FEVER dataset, reaching an accuracy of 88.0%, highlighting effective integration of real-time monitoring capabilities.

- The framework's performance significantly surpasses traditional methods in efficiency and responsiveness for cross-asset risk management.

- The integration of LLMs allows for a multifaceted approach to risk management, improving prediction accuracy of market fluctuations and enhancing overall financial stability.

Significance

This research is important as it presents a novel approach to cross-asset risk management using LLMs, which can improve decision-making processes, enhance risk assessment, and promote financial stability by enabling real-time monitoring and contextualized risk interpretation.

Technical Contribution

The paper proposes a Cross-Asset Risk Management framework that leverages LLMs for real-time monitoring and dynamic risk assessment, integrating diverse data sources and employing advanced analytics for contextualized risk interpretation.

Novelty

The novelty of this work lies in its application of LLMs to cross-asset risk management, enabling comprehensive and contextualized risk assessment through the synthesis of diverse financial data sources and narratives.

Limitations

- The study does not discuss potential challenges in acquiring and maintaining high-quality, diverse datasets for continuous model training.

- There is no explicit mention of possible biases in LLMs that could affect risk assessment accuracy.

Future Work

- Investigate methods to mitigate data quality and bias issues in LLM-based risk management frameworks.

- Explore the applicability of this framework to other financial domains, such as derivatives or alternative investments.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing and Hedging Strategies for Cross-Currency Equity Protection Swaps

Huansang Xu, Marek Rutkowski

Real-time Risk Metrics for Programmatic Stablecoin Crypto Asset-Liability Management (CALM)

Marcel Bluhm, Adrian Cachinero Vasiljević, Sébastien Derivaux et al.

Cross-Impact of Order Flow Imbalance in Equity Markets

Chao Zhang, Mihai Cucuringu, Rama Cont

No citations found for this paper.

Comments (0)