Authors

Summary

We investigate the impact of order flow imbalance (OFI) on price movements in equity markets in a multi-asset setting. First, we propose a systematic approach for combining OFIs at the top levels of the limit order book into an integrated OFI variable which better explains price impact, compared to the best-level OFI. We show that once the information from multiple levels is integrated into OFI, multi-asset models with cross-impact do not provide additional explanatory power for contemporaneous impact compared to a sparse model without cross-impact terms. On the other hand, we show that lagged cross-asset OFIs do improve the forecasting of future returns. We also establish that this lagged cross-impact mainly manifests at short-term horizons and decays rapidly in time.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research investigates the impact of order flow imbalance (OFI) on price movements in equity markets using a systematic approach to combine OFIs from multiple levels of the limit order book into an integrated OFI variable. It compares the explanatory power of models with and without cross-impact terms for contemporaneous and future returns.

Key Results

- Integrated OFI provides higher explanatory power for price movements compared to best-level OFI.

- Lagged cross-asset OFIs improve the forecasting of future returns, particularly at short-term horizons.

- Cross-impact models with integrated OFI do not offer additional explanatory power over price impact models with integrated OFI for contemporaneous returns.

- Forecast-implied trading strategies based on forward-looking cross-impact models outperform those based on forward-looking price impact models.

- Predictability of cross-impact terms vanishes quickly over longer forecasting horizons.

Significance

This research is significant as it provides insights into how order flow imbalance across multiple assets and levels of the limit order book influences price dynamics and return forecasts, which can inform trading strategies and risk management in equity markets.

Technical Contribution

The paper introduces a method for integrating order flow imbalance information from multiple levels of the limit order book and demonstrates its superiority in explaining price movements and improving return forecasts compared to models using only best-level OFI.

Novelty

The novelty of this research lies in its systematic approach to combining multi-level OFI into an integrated variable, which enhances the explanation of price impact, and its focus on the predictive power of cross-impact terms for future returns in a multi-asset setting.

Limitations

- The study focuses on minute-level data, which may not capture all the complexities at higher frequency levels.

- The findings are based on a specific dataset and may not be universally applicable across all market conditions or different asset classes.

Future Work

- Investigate the predictability of cross-impact terms over multiple horizons in more detail.

- Explore the impact of multi-level OFI on forecasting returns using more granular data, such as high-frequency limit order book data.

- Examine whether cross-asset multi-level OFI can improve return forecasts over longer time horizons.

Paper Details

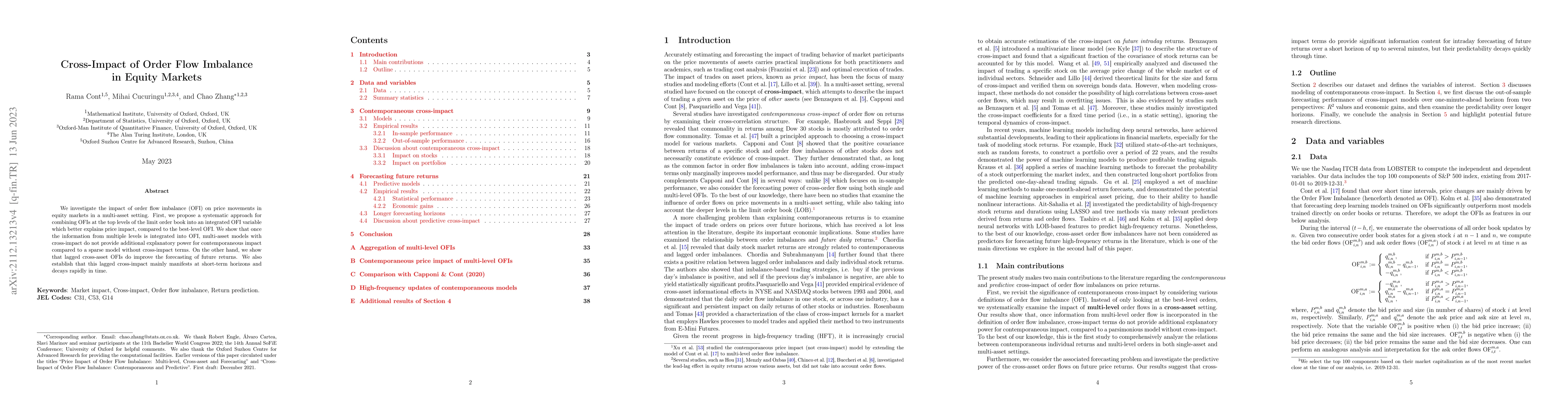

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrade Co-occurrence, Trade Flow Decomposition, and Conditional Order Imbalance in Equity Markets

Mihai Cucuringu, Gesine Reinert, Yutong Lu

| Title | Authors | Year | Actions |

|---|

Comments (0)