Authors

Summary

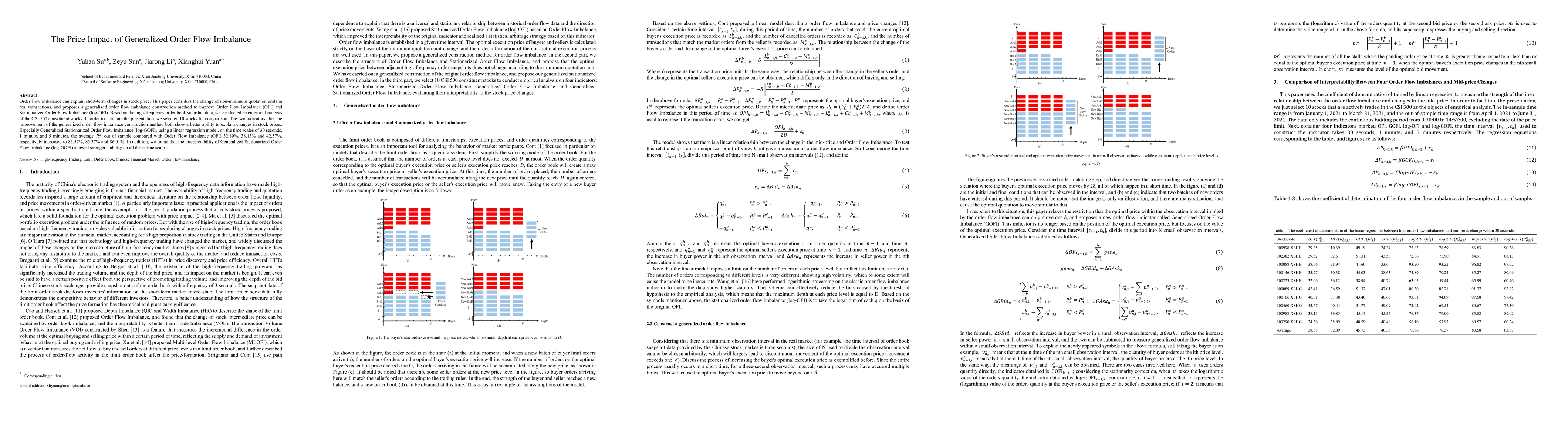

Order flow imbalance can explain short-term changes in stock price. This paper considers the change of non-minimum quotation units in real transactions, and proposes a generalized order flow imbalance construction method to improve Order Flow Imbalance (OFI) and Stationarized Order Flow Imbalance (log-OFI). Based on the high-frequency order book snapshot data, we conducted an empirical analysis of the CSI 500 constituent stocks. In order to facilitate the presentation, we selected 10 stocks for comparison. The two indicators after the improvement of the generalized order flow imbalance construction method both show a better ability to explain changes in stock prices. Especially Generalized Stationarized Order Flow Imbalance (log-GOFI), using a linear regression model, on the time scales of 30 seconds, 1 minute, and 5 minutes, the average R-squared out of sample compared with Order Flow Imbalance (OFI) 32.89%, 38.13% and 42.57%, respectively increased to 83.57%, 85.37% and 86.01%. In addition, we found that the interpretability of Generalized Stationarized Order Flow Imbalance (log-GOFI) showed stronger stability on all three time scales.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Impact of Order Flow Imbalance in Equity Markets

Chao Zhang, Mihai Cucuringu, Rama Cont

| Title | Authors | Year | Actions |

|---|

Comments (0)