Summary

We study the price impact of order book events - limit orders, market orders and cancelations - using the NYSE TAQ data for 50 U.S. stocks. We show that, over short time intervals, price changes are mainly driven by the order flow imbalance, defined as the imbalance between supply and demand at the best bid and ask prices. Our study reveals a linear relation between order flow imbalance and price changes, with a slope inversely proportional to the market depth. These results are shown to be robust to seasonality effects, and stable across time scales and across stocks. We argue that this linear price impact model, together with a scaling argument, implies the empirically observed "square-root" relation between price changes and trading volume. However, the relation between price changes and trade volume is found to be noisy and less robust than the one based on order flow imbalance.

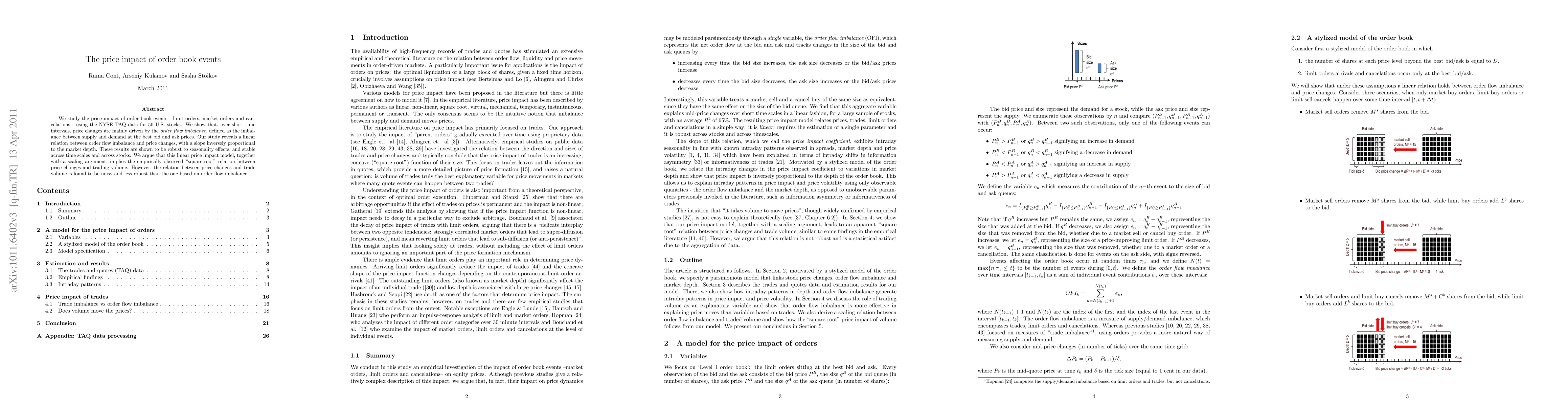

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)