Summary

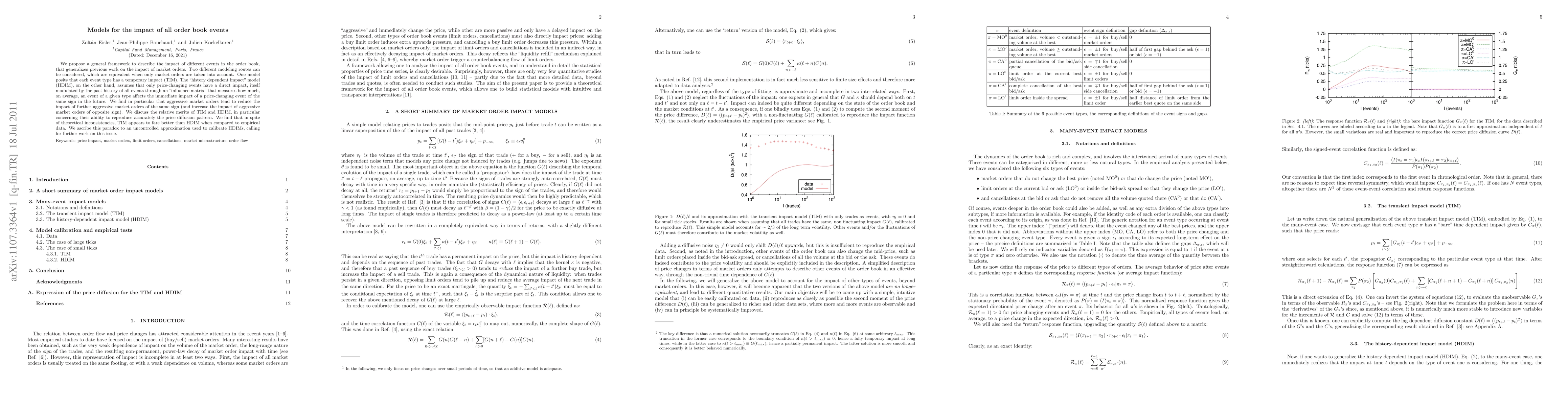

We propose a general framework to describe the impact of different events in the order book, that generalizes previous work on the impact of market orders. Two different modeling routes can be considered, which are equivalent when only market orders are taken into account. One model posits that each event type has a temporary impact (TIM). The "history dependent impact" model (HDIM), on the other hand, assumes that only price-changing events have a direct impact, itself modulated by the past history of all events through an "influence matrix" that measures how much, on average, an event of a given type affects the immediate impact of a price-changing event of the same sign in the future. We find in particular that aggressive market orders tend to reduce the impact of further aggressive market orders of the same sign (and increase the impact of aggressive market orders of opposite sign). We discuss the relative merits of TIM and HDIM, in particular concerning their ability to reproduce accurately the price diffusion pattern. We find that in spite of theoretical inconsistencies, TIM appears to fare better than HDIM when compared to empirical data. We ascribe this paradox to an uncontrolled approximation used to calibrate HDIMs, calling for further work on this issue.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)