Authors

Summary

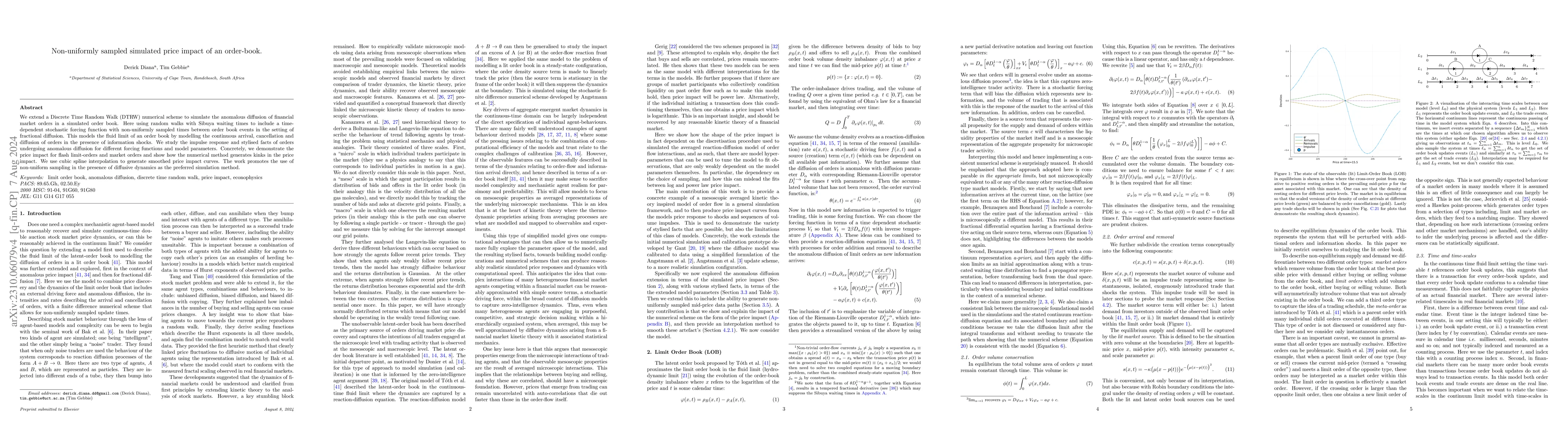

We extend a Discrete Time Random Walk (DTRW) numerical scheme to simulate the anomalous diffusion of financial market orders in a simulated order book. Here using random walks with Sibuya waiting times to include a time-dependent stochastic forcing function with non-uniformly sampled times between order book events in the setting of fractional diffusion. This models the fluid limit of an order book by modelling the continuous arrival, cancellation and diffusion of orders in the presence of information shocks. We study the impulse response and stylised facts of orders undergoing anomalous diffusion for different forcing functions and model parameters. Concretely, we demonstrate the price impact for flash limit-orders and market orders and show how the numerical method generate kinks in the price impact. We use cubic spline interpolation to generate smoothed price impact curves. The work promotes the use of non-uniform sampling in the presence of diffusive dynamics as the preferred simulation method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJump diffusion approximation for the price dynamics of a fully state dependent limit order book model

Dörte Kreher, Cassandra Milbradt

| Title | Authors | Year | Actions |

|---|

Comments (0)