Tim Gebbie

12 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

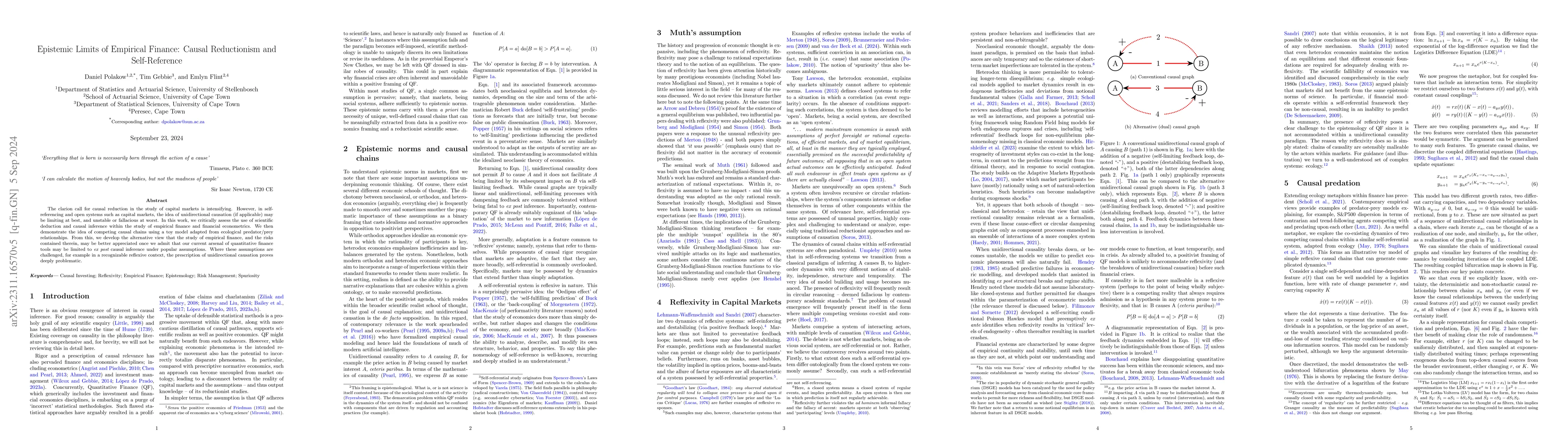

Epistemic Limits of Empirical Finance: Causal Reductionism and Self-Reference

The clarion call for causal reduction in the study of capital markets is intensifying. However, in self-referencing and open systems such as capital markets, the idea of unidirectional causation (if...

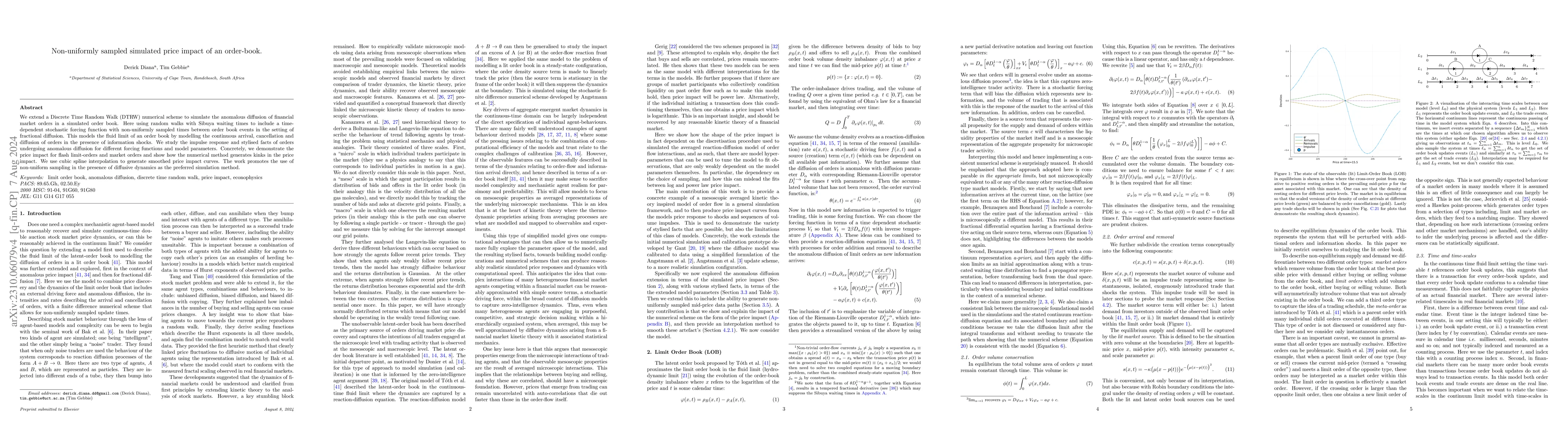

Anomalous diffusion and price impact in the fluid-limit of an order book

We extend a Discrete Time Random Walk (DTRW) numerical scheme to simulate the anomalous diffusion of financial market orders in a simulated order book. Here using random walks with Sibuya waiting ti...

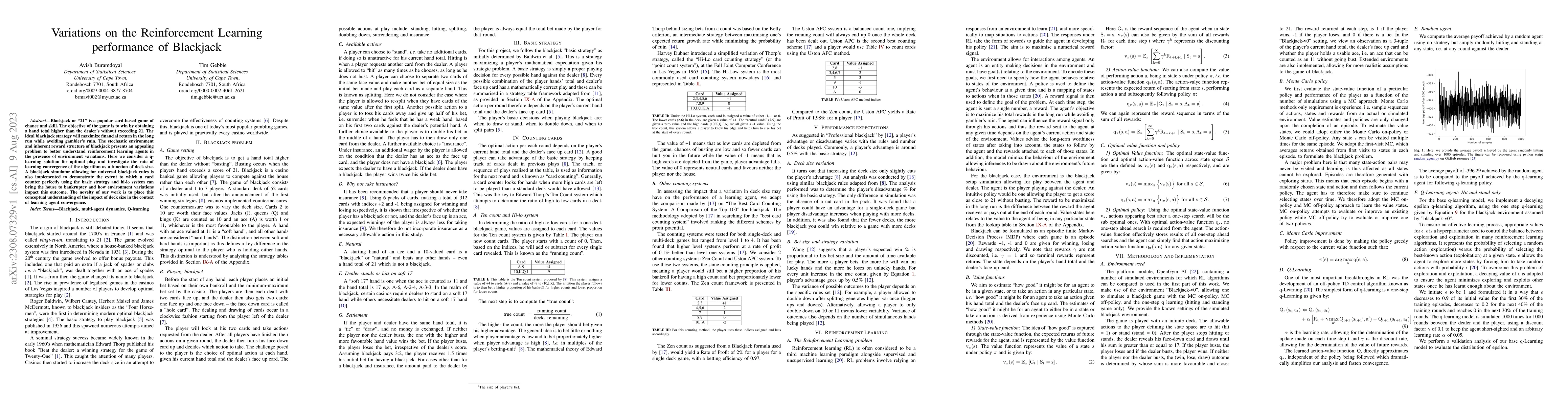

Variations on the Reinforcement Learning performance of Blackjack

Blackjack or "21" is a popular card-based game of chance and skill. The objective of the game is to win by obtaining a hand total higher than the dealer's without exceeding 21. The ideal blackjack s...

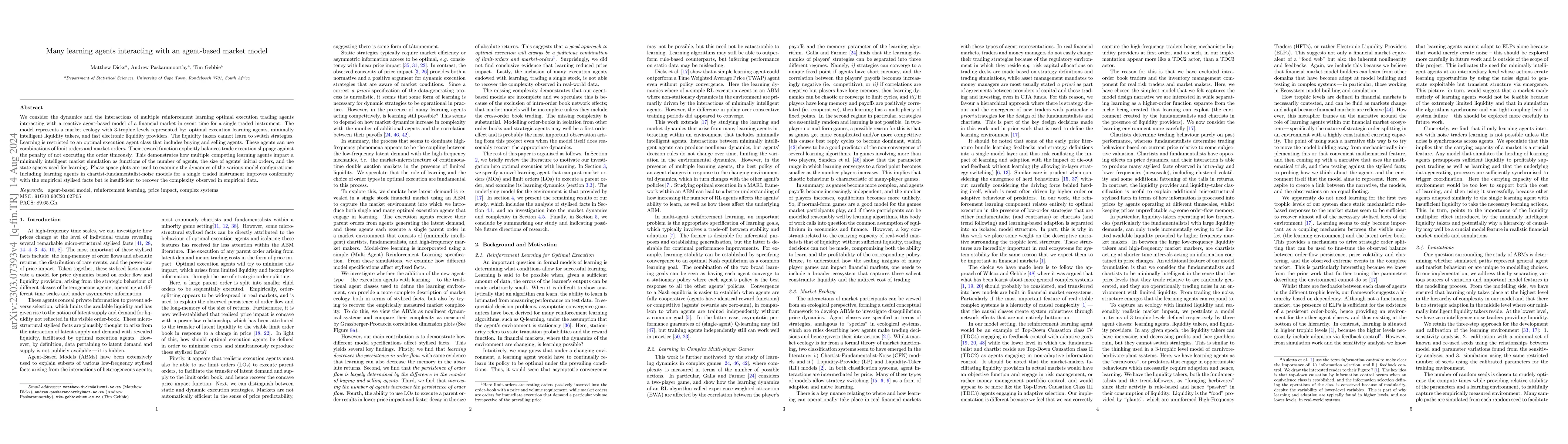

Many learning agents interacting with an agent-based market model

We consider the dynamics and the interactions of multiple reinforcement learning optimal execution trading agents interacting with a reactive Agent-Based Model (ABM) of a financial market in event t...

A simple learning agent interacting with an agent-based market model

We consider the learning dynamics of a single reinforcement learning optimal execution trading agent when it interacts with an event driven agent-based financial market model. Trading takes place as...

Geometric insights into robust portfolio construction

We investigate and extend the results of Golts and Jones (2009) that an $\alpha$-weight angle resulting from unconstrained quadratic portfolio optimisations has an upper bound dependent on the condi...

The efficient frontiers of mean-variance portfolio rules under distribution misspecification

Mean-variance portfolio decisions that combine prediction and optimisation have been shown to have poor empirical performance. Here, we consider the performance of various shrinkage methods by their...

CoinTossX: An open-source low-latency high-throughput matching engine

We deploy and demonstrate the CoinTossX low-latency, high-throughput, open-source matching engine with orders sent using the Julia and Python languages. We show how this can be deployed for small-sc...

Agglomerative Likelihood Clustering

We consider the problem of fast time-series data clustering. Building on previous work modeling the correlation-based Hamiltonian of spin variables we present an updated fast non-expensive Agglomera...

Representation Learning for Regime detection in Block Hierarchical Financial Markets

We consider financial market regime detection from the perspective of deep representation learning of the causal information geometry underpinning traded asset systems using a hierarchical correlation...

Correlation emergence in two coupled simulated limit order books

We use random walks to simulate the fluid limit of two coupled diffusive limit order books to model correlation emergence. The model implements the arrival, cancellation and diffusion of orders couple...

The bias of IID resampled backtests for rolling-window mean-variance portfolios

Backtests on historical data are the basis for practical evaluations of portfolio selection rules, but their reliability is often limited by reliance on a single sample path. This can lead to high est...