Authors

Summary

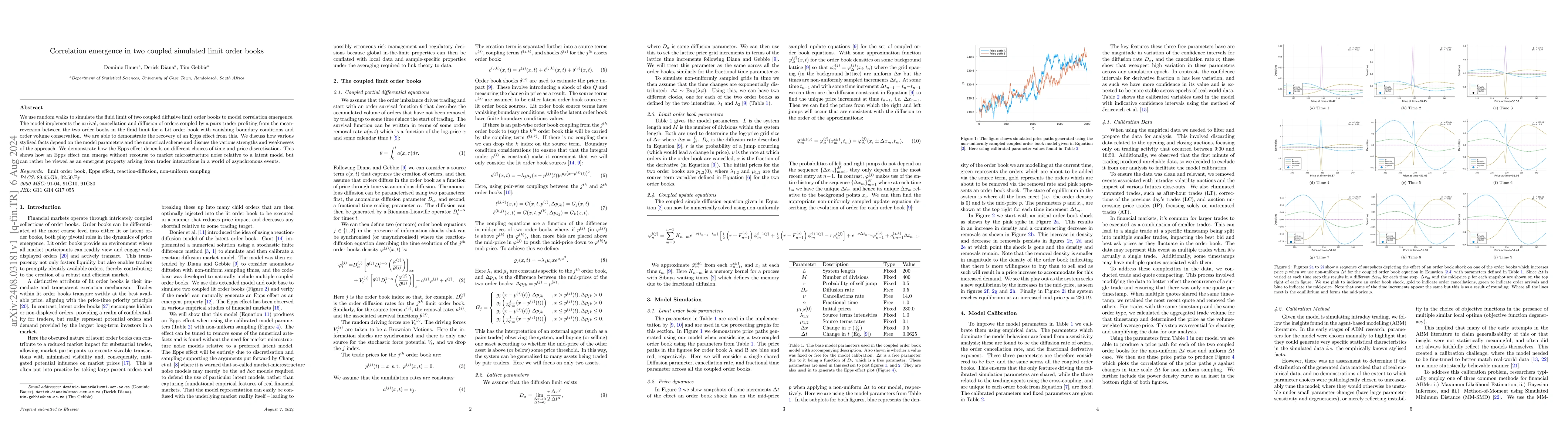

We use random walks to simulate the fluid limit of two coupled diffusive limit order books to model correlation emergence. The model implements the arrival, cancellation and diffusion of orders coupled by a pairs trader profiting from the mean-reversion between the two order books in the fluid limit for a Lit order book with vanishing boundary conditions and order volume conservation. We are able to demonstrate the recovery of an Epps effect from this. We discuss how various stylised facts depend on the model parameters and the numerical scheme and discuss the various strengths and weaknesses of the approach. We demonstrate how the Epps effect depends on different choices of time and price discretisation. This shows how an Epps effect can emerge without recourse to market microstructure noise relative to a latent model but can rather be viewed as an emergent property arising from trader interactions in a world of asynchronous events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTwo Price Regimes in Limit Order Books: Liquidity Cushion and Fragmented Distant Field

Thomas Guhr, Edgar Jungblut, Sebastian M. Krause

| Title | Authors | Year | Actions |

|---|

Comments (0)