Summary

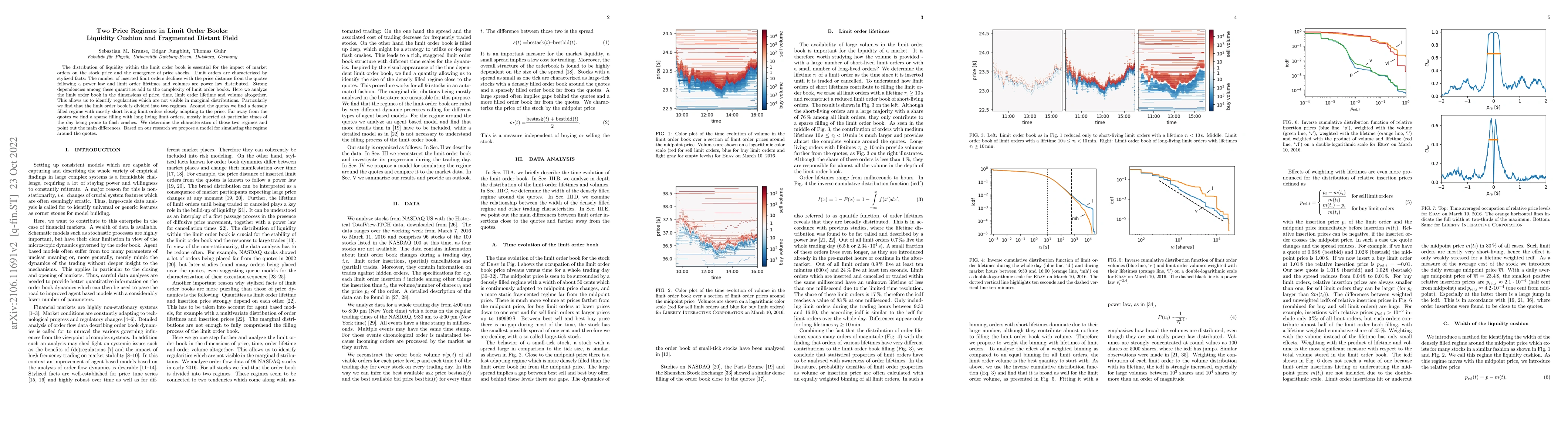

The distribution of liquidity within the limit order book is essential for the impact of market orders on the stock price and the emergence of price shocks. Limit orders are characterized by stylized facts: The number of inserted limit orders declines with the price distance from the quotes following a power law and limit order lifetimes and volumes are power law distributed. Strong dependencies among these quantities add to the complexity of limit order books. Here we analyze the limit order book in the dimensions of price, time, limit order lifetime and volume altogether. This allows us to identify regularities which are not visible in marginal distributions. Particularly we find that the limit order book is divided into two regimes. Around the quotes we find a densely filled regime with mostly short living limit orders closely adapting to the price. Far away from the quotes we find a sparse filling with long living limit orders, mostly inserted at particular times of the day being prone to flash crashes. We determine the characteristics of those two regimes and point out the main differences. Based on our research we propose a model for simulating the regime around the quotes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCorrelation emergence in two coupled simulated limit order books

Tim Gebbie, Derick Diana, Dominic Bauer

No citations found for this paper.

Comments (0)