Summary

In financial markets, the order flow, defined as the process assuming value one for buy market orders and minus one for sell market orders, displays a very slowly decaying autocorrelation function. Since orders impact prices, reconciling the persistence of the order flow with market efficiency is a subtle issue. A possible solution is provided by asymmetric liquidity, which states that the impact of a buy or sell order is inversely related to the probability of its occurrence. We empirically find that when the order flow predictability increases in one direction, the liquidity in the opposite side decreases, but the probability that a trade moves the price decreases significantly. While the last mechanism is able to counterbalance the persistence of order flow and restore efficiency and diffusivity, the first acts in opposite direction. We introduce a statistical order book model where the persistence of the order flow is mitigated by adjusting the market order volume to the predictability of the order flow. The model reproduces the diffusive behaviour of prices at all time scales without fine-tuning the values of parameters, as well as the behaviour of most order book quantities as a function of the local predictability of order flow.

AI Key Findings

Generated Sep 03, 2025

Methodology

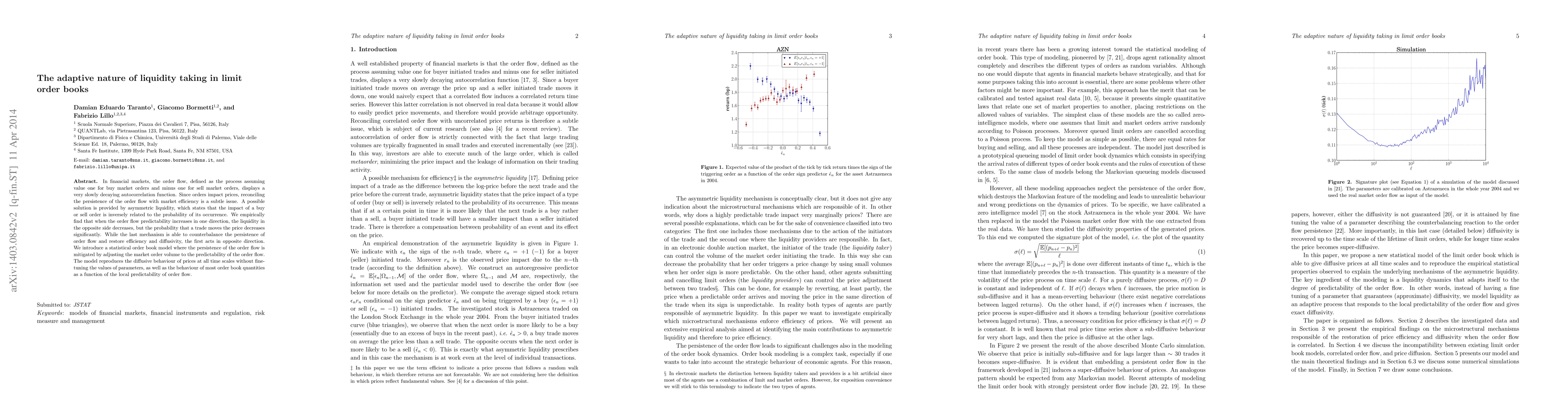

The paper introduces a statistical order book model with long-memory order flow, adapting the value of a parameter dynamically based on the local predictability of order flow to ensure price diffusivity and correct conditional properties of the order book.

Key Results

- The model successfully reproduces diffusive price behavior at all time scales without fine-tuning parameters.

- Liquidity takers adapt their market order volumes based on the predictability of order flow, counterbalancing the persistence of order flow and enhancing market efficiency.

- Asymmetric liquidity is empirically found to counteract the persistence of order flow, restoring efficiency and diffusivity in financial markets.

Significance

This research contributes to understanding how financial markets maintain efficiency in the presence of persistent order flow, providing insights into the adaptive behavior of liquidity takers and providers.

Technical Contribution

The paper proposes a novel statistical order book model that incorporates adaptive liquidity-taking behavior, ensuring price diffusivity and correct conditional properties of the order book as a function of order flow predictability.

Novelty

The model's key innovation lies in dynamically adjusting the market order volume based on order flow predictability, distinguishing it from previous models that either fine-tune parameters or lack adaptation mechanisms.

Limitations

- The model's assumptions and simplifications may not capture all complexities of real-world order book dynamics.

- Empirical validation is limited to the datasets analyzed (AAPL, MSFT, AZN, VOD) and may not generalize to all markets or assets.

Future Work

- Further investigation into the adaptive behavior of liquidity providers could refine the model.

- Expanding the dataset to include more diverse financial instruments and markets could validate the model's generalizability.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTwo Price Regimes in Limit Order Books: Liquidity Cushion and Fragmented Distant Field

Thomas Guhr, Edgar Jungblut, Sebastian M. Krause

An Algebraic Framework for the Modeling of Limit Order Books

Johannes Bleher, Michael Bleher

| Title | Authors | Year | Actions |

|---|

Comments (0)