Authors

Summary

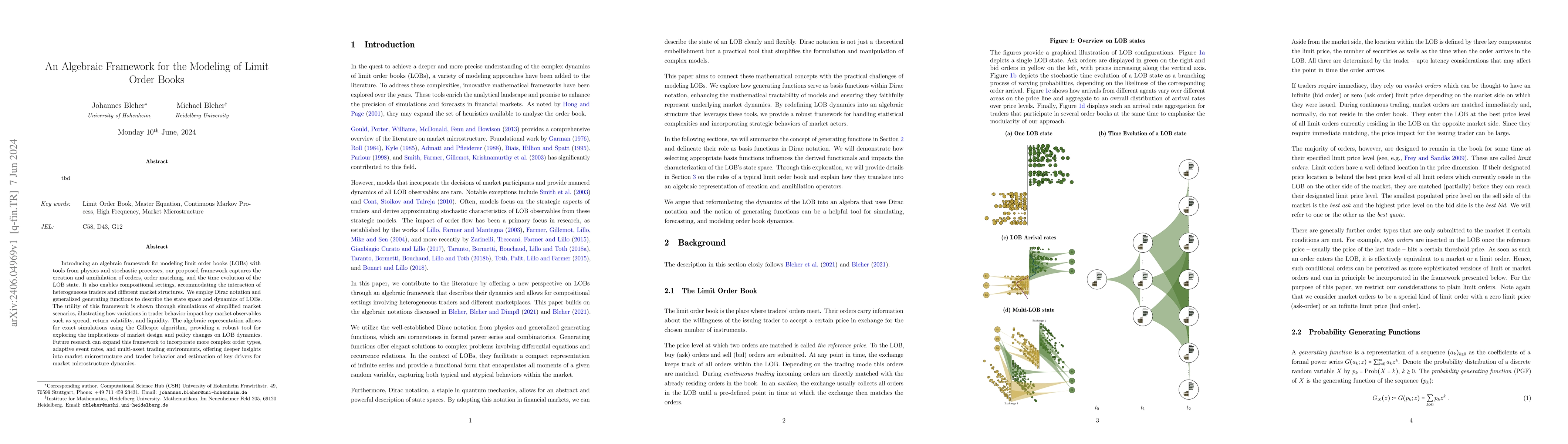

Introducing an algebraic framework for modeling limit order books (LOBs) with tools from physics and stochastic processes, our proposed framework captures the creation and annihilation of orders, order matching, and the time evolution of the LOB state. It also enables compositional settings, accommodating the interaction of heterogeneous traders and different market structures. We employ Dirac notation and generalized generating functions to describe the state space and dynamics of LOBs. The utility of this framework is shown through simulations of simplified market scenarios, illustrating how variations in trader behavior impact key market observables such as spread, return volatility, and liquidity. The algebraic representation allows for exact simulations using the Gillespie algorithm, providing a robust tool for exploring the implications of market design and policy changes on LOB dynamics. Future research can expand this framework to incorporate more complex order types, adaptive event rates, and multi-asset trading environments, offering deeper insights into market microstructure and trader behavior and estimation of key drivers for market microstructure dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)