Authors

Summary

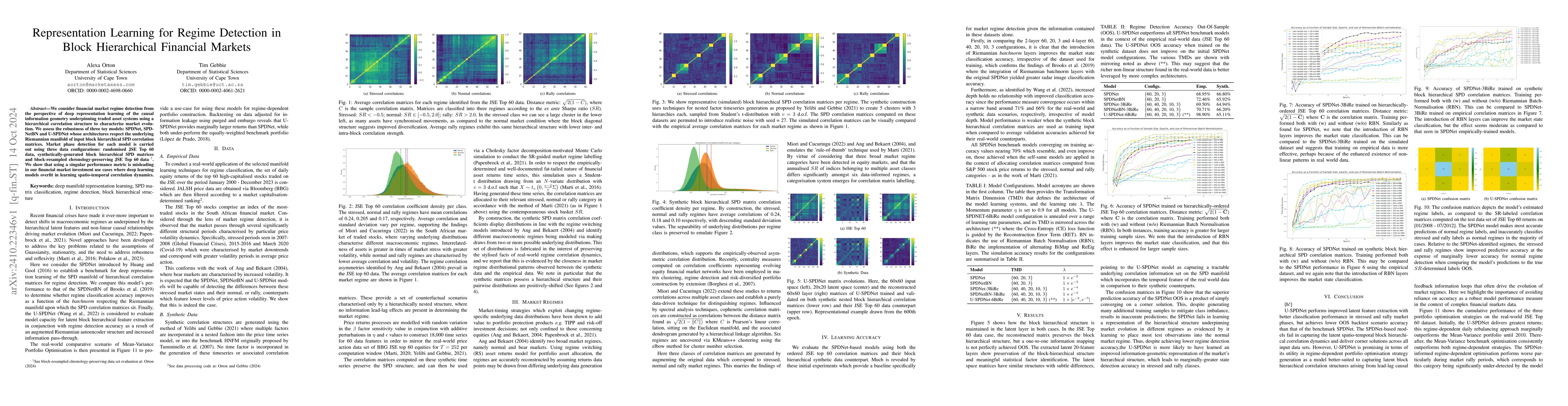

We consider financial market regime detection from the perspective of deep representation learning of the causal information geometry underpinning traded asset systems using a hierarchical correlation structure to characterise market evolution. We assess the robustness of three toy models: SPDNet, SPD-NetBN and U-SPDNet whose architectures respect the underlying Riemannian manifold of input block hierarchical SPD correlation matrices. Market phase detection for each model is carried out using three data configurations: randomised JSE Top 60 data, synthetically-generated block hierarchical SPD matrices and block-resampled chronology-preserving JSE Top 60 data. We show that using a singular performance metric is misleading in our financial market investment use cases where deep learning models overfit in learning spatio-temporal correlation dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVolume-Centred Range Bars: Novel Interpretable Representation of Financial Markets Designed for Machine Learning Applications

Jaume Bacardit, Luca Arnaboldi, Artur Sokolovsky et al.

No citations found for this paper.

Comments (0)