Summary

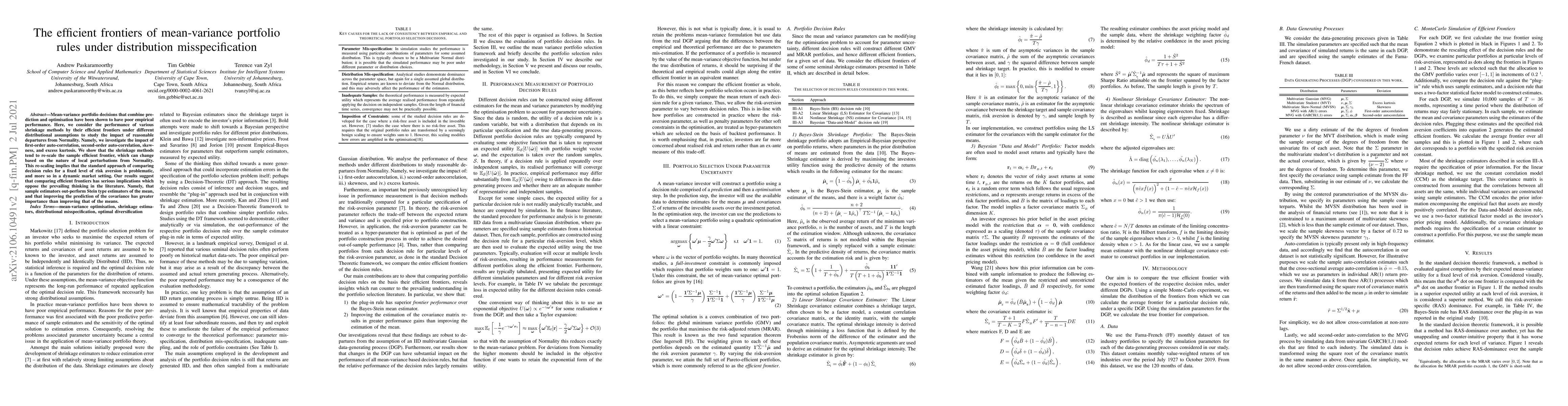

Mean-variance portfolio decisions that combine prediction and optimisation have been shown to have poor empirical performance. Here, we consider the performance of various shrinkage methods by their efficient frontiers under different distributional assumptions to study the impact of reasonable departures from Normality. Namely, we investigate the impact of first-order auto-correlation, second-order auto-correlation, skewness, and excess kurtosis. We show that the shrinkage methods tend to re-scale the sample efficient frontier, which can change based on the nature of local perturbations from Normality. This re-scaling implies that the standard approach of comparing decision rules for a fixed level of risk aversion is problematic, and more so in a dynamic market setting. Our results suggest that comparing efficient frontiers has serious implications which oppose the prevailing thinking in the literature. Namely, that sample estimators out-perform Stein type estimators of the mean, and that improving the prediction of the covariance has greater importance than improving that of the means.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNewsvendor under Mean-Variance Ambiguity and Misspecification

Feng Liu, Zhi Chen, Ruodu Wang et al.

Portfolio Optimization Rules beyond the Mean-Variance Approach

Maxime Markov, Vladimir Markov

| Title | Authors | Year | Actions |

|---|

Comments (0)