Authors

Summary

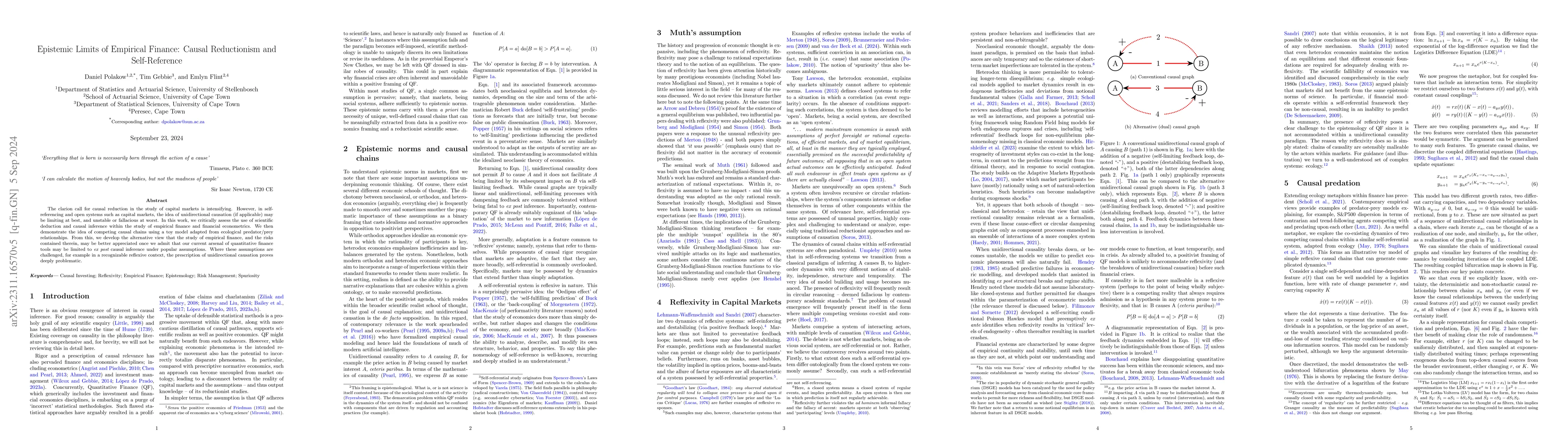

The clarion call for causal reduction in the study of capital markets is intensifying. However, in self-referencing and open systems such as capital markets, the idea of unidirectional causation (if applicable) may be limiting at best, and unstable or fallacious at worst. In this research, we critically assess the use of scientific deduction and causal inference within the study of empirical finance and econometrics. We then demonstrate the idea of competing causal chains using a toy model adapted from ecological predator/prey relationships. From this, we develop the alternative view that the study of empirical finance, and the risks contained therein, may be better appreciated once we admit that our current arsenal of quantitative finance tools may be limited to ex post causal inference under popular assumptions. Where these assumptions are challenged, for example in a recognizable reflexive context, the prescription of unidirectional causation proves deeply problematic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNuance Matters: Probing Epistemic Consistency in Causal Reasoning

Luca Mouchel, Shaobo Cui, Boi Faltings et al.

Causal Inference for Banking Finance and Insurance A Survey

Yelleti Vivek, Vadlamani Ravi, Satyam Kumar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)