Summary

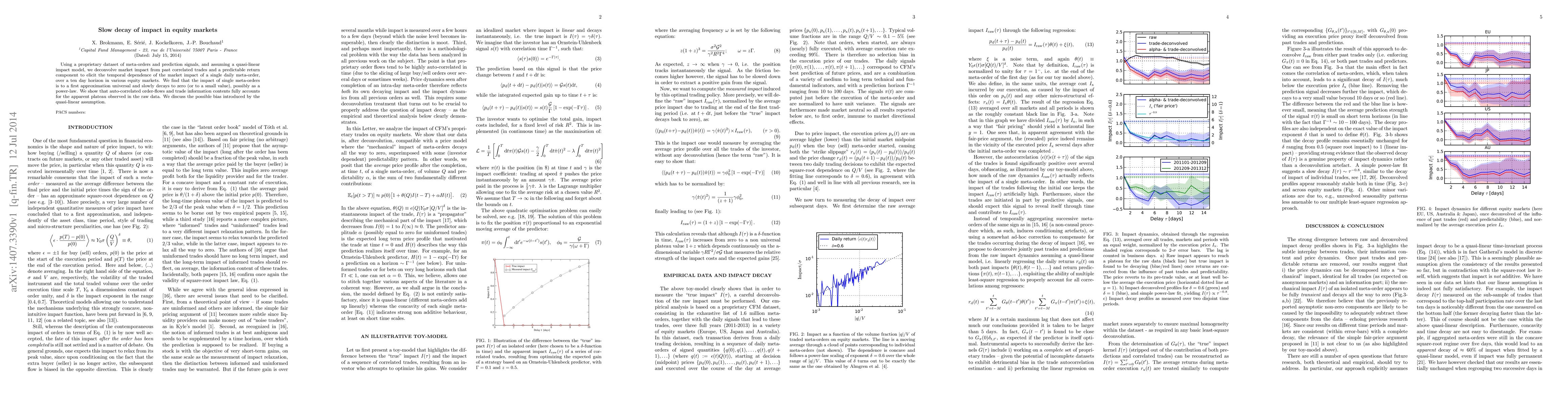

Using a proprietary dataset of meta-orders and prediction signals, and assuming a quasi-linear impact model, we deconvolve market impact from past correlated trades and a predictable return component to elicit the temporal dependence of the market impact of a single daily meta-order, over a ten day horizon in various equity markets. We find that the impact of single meta-orders is to a first approximation universal and slowly decays to zero (or to a small value), possibly as a power-law. We show that auto-correlated order-flows and trade information contents fully accounts for the apparent plateau observed in the raw data. We discuss the possible bias introduced by the quasi-linear assumption.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross-Impact of Order Flow Imbalance in Equity Markets

Chao Zhang, Mihai Cucuringu, Rama Cont

| Title | Authors | Year | Actions |

|---|

Comments (0)