Summary

We consider a financial market with one riskless and one risky asset. The super-replication theorem states that there is no duality gap in the problem of super-replicating a contingent claim under transaction costs and the associated dual problem. We give two versions of this theorem. The first theorem relates a num\'eraire-based admissibility condition in the primal problem to the notion of a local martingale in the dual problem. The second theorem relates a num\'eraire -free admissibility condition in the primal problem to the notion of a uniformly integrable martingale in the dual problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

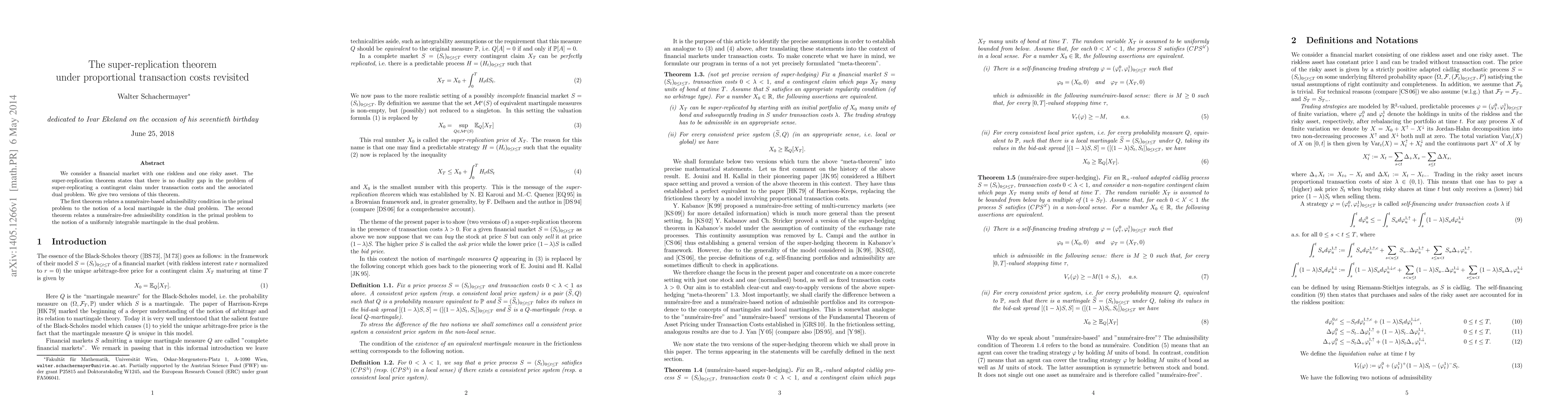

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)