Summary

We consider a discrete time financial market with proportional transaction cost under model uncertainty, and study a super-replication problem. We recover the duality results that are well known in the classical dominated context. Our key argument consists in using a randomization technique together with the minimax theorem to convert the initial problem to a frictionless problem set on an enlarged space. This allows us to appeal to the techniques and results of Bouchard and Nutz (2015) to obtain the duality result.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

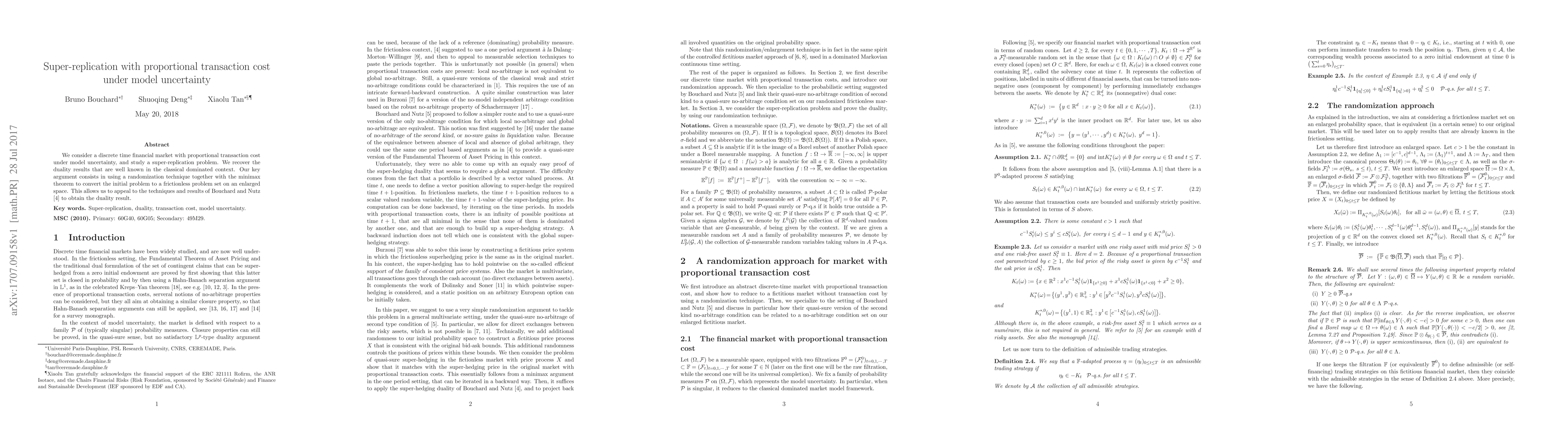

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)