Summary

In this paper, we introduce a methodology based on the zero-inflated cure rate model to detect fraudsters in bank loan applications. In fact, our approach enables us to accommodate three different types of loan applicants, i.e., fraudsters, those who are susceptible to default and finally, those who are not susceptible to default. An advantage of our approach is to accommodate zero-inflated times, which is not possible in the standard cure rate model. To illustrate the proposed method, a real dataset of loan survival times is fitted by the zero-inflated Weibull cure rate model. The parameter estimation is reached by maximum likelihood estimation procedure and Monte Carlo simulations are carried out to check its finite sample performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

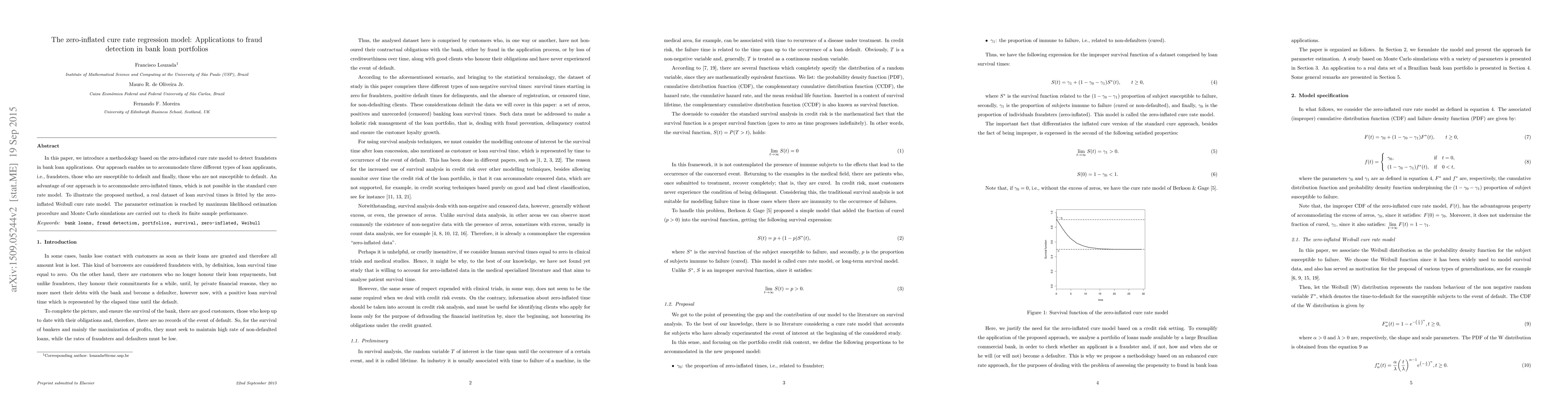

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)