Summary

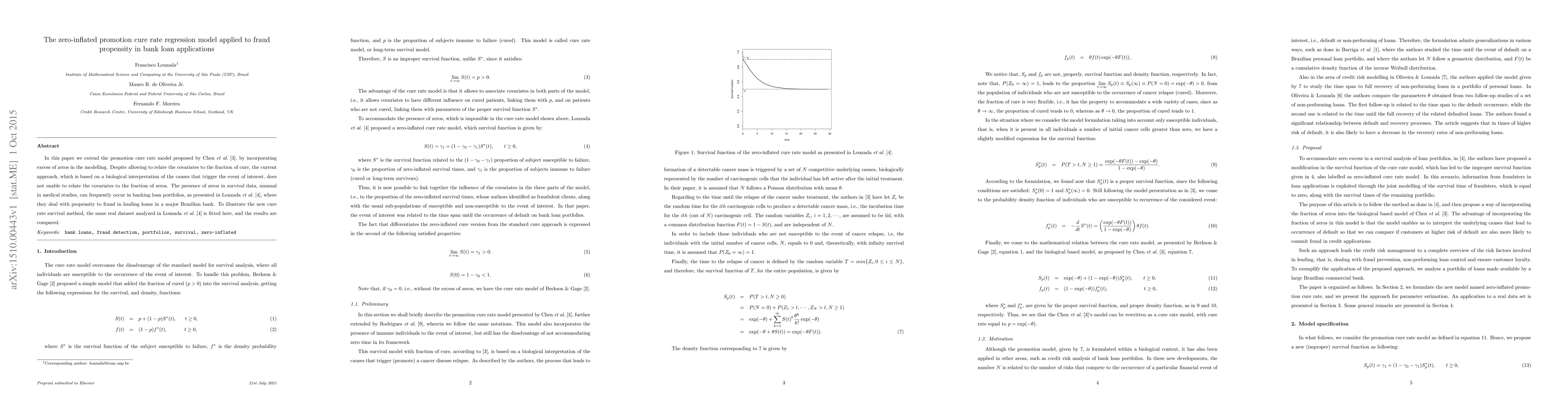

In this paper we extend the promotion cure rate model proposed by Chen et al (1999), by incorporating excess of zeros in the modelling. Despite allowing to relate the covariates to the fraction of cure, the current approach, which is based on a biological interpretation of the causes that trigger the event of interest, does not enable to relate the covariates to the fraction of zeros. The presence of zeros in survival data, unusual in medical studies, can frequently occur in banking loan portfolios, as presented in Louzada et al (2015), where they deal with propensity to fraud in lending loans in a major Brazilian bank. To illustrate the new cure rate survival method, the same real dataset analyzed in Louzada et al (2015) is fitted here, and the results are compared.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)