Summary

We study the asymptotic behavior of the difference between the values at risk VaR(L) and VaR(L+S) for heavy tailed random variables L and S for application in sensitivity analysis of quantitative operational risk management within the framework of the advanced measurement approach of Basel II (and III). Here L describes the loss amount of the present risk profile and S describes the loss amount caused by an additional loss factor. We obtain different types of results according to the relative magnitudes of the thicknesses of the tails of L and S. In particular, if the tail of S is sufficiently thinner than the tail of L, then the difference between prior and posterior risk amounts VaR(L+S) - VaR(L) is asymptotically equivalent to the expectation (expected loss) of S.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

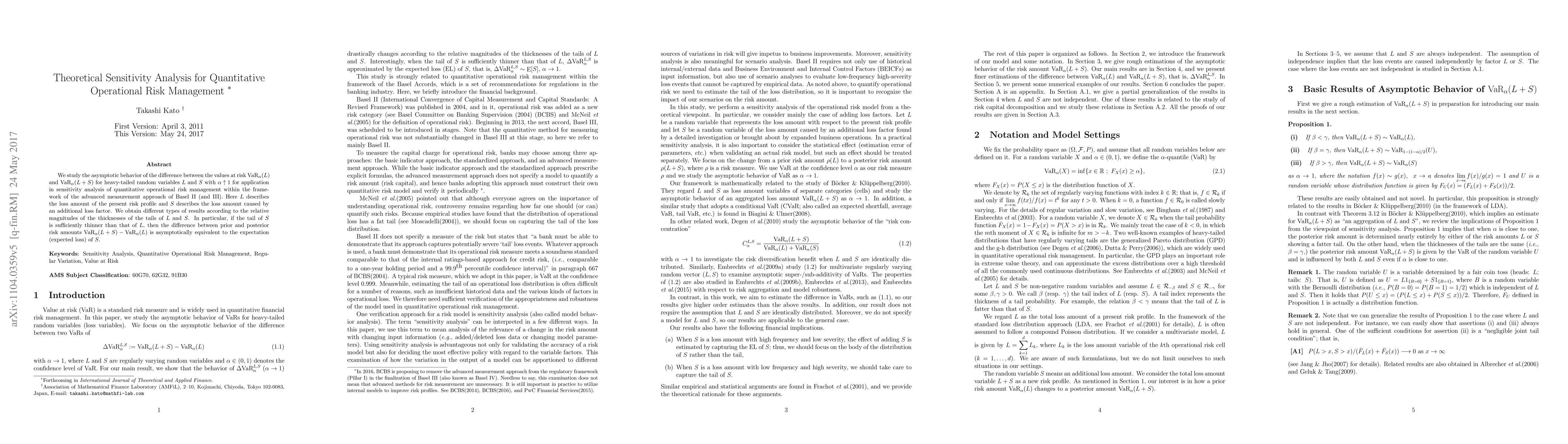

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA text analysis for Operational Risk loss descriptions

Ricardas Zitikis, Francesca Greselin, Davide Di Vincenzo et al.

Guidelines for cyber risk management in shipboard operational technology systems

Jianying Zhou, Mark Goh, Priyanga Rajaram

| Title | Authors | Year | Actions |

|---|

Comments (0)