Summary

In financial markets valuable information is rarely circulated homogeneously, because of time required for information to spread. However, advances in communication technology means that the 'lifetime' of important information is typically short. Hence, viewed as a tradable asset, information shares the characteristics of a perishable commodity: while it can be stored and transmitted freely, its worth diminishes rapidly in time. In view of recent developments where internet search engines and other information providers are offering information to financial institutions, the problem of pricing information is becoming increasingly important. With this in mind, a new formulation of utility-indifference argument is introduced and used as a basis for pricing information. Specifically, we regard information as a quantity that converts a prior distribution into a posterior distribution. The amount of information can then be quantified by relative entropy. The key to our utility indifference argument is to equate the maximised a posterior utility, after paying certain cost for the information, with the a posterior expectation of the utility based on the a priori optimal strategy. This formulation leads to one price for a given quantity of upside information; and another price for a given quantity of downside information. The ideas are illustrated by means of simple examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

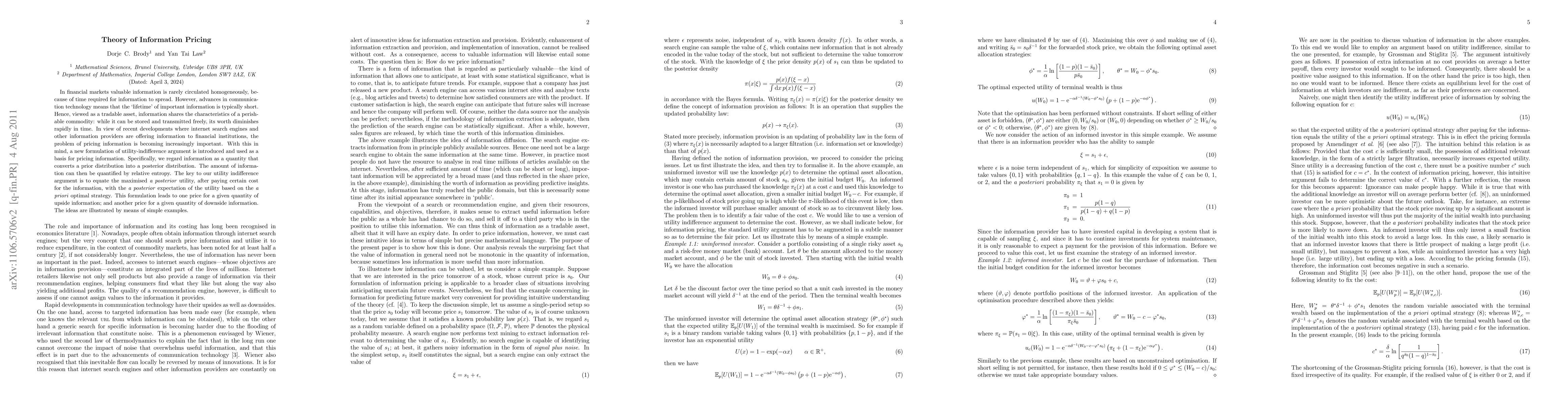

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)