Summary

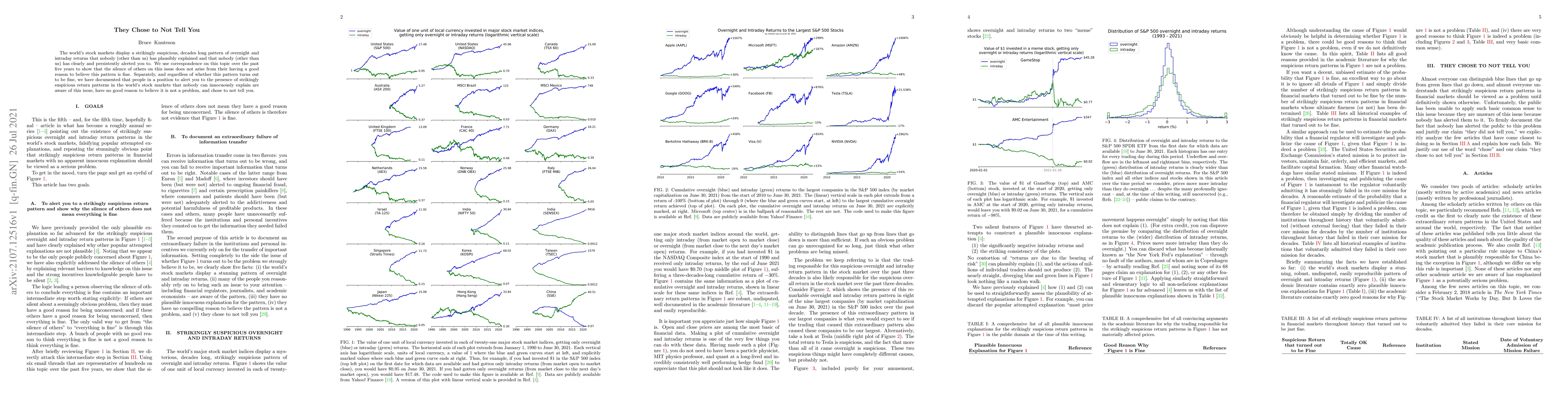

The world's stock markets display a strikingly suspicious, decades long pattern of overnight and intraday returns that nobody (other than us) has plausibly explained and that nobody (other than us) has clearly and persistently alerted you to. We use correspondence on this topic over the past five years to show that the silence of others on this issue does not arise from their having a good reason to believe this pattern is fine. Separately, and regardless of whether this pattern turns out to be fine, we have documented that people in a position to alert you to the presence of strikingly suspicious return patterns in the world's stock markets that nobody can innocuously explain are aware of this issue, have no good reason to believe it is not a problem, and chose to not tell you.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Roles of Symbols in Neural-based AI: They are Not What You Think!

Tom M. Mitchell, Daniel L. Silver

No citations found for this paper.

Comments (0)