Authors

Summary

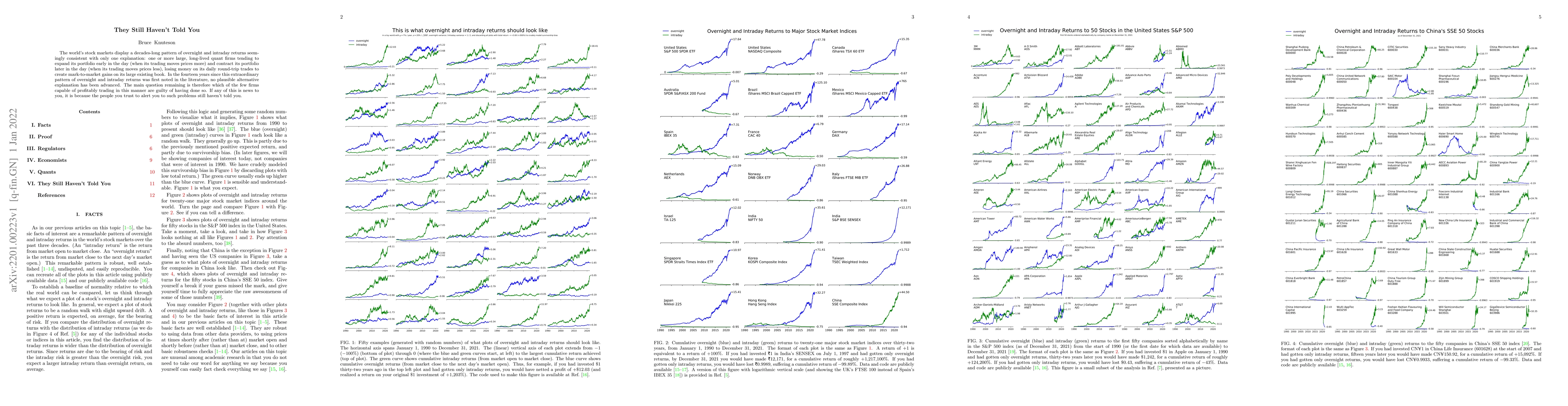

The world's stock markets display a decades-long pattern of overnight and intraday returns seemingly consistent with only one explanation: one or more large, long-lived quant firms tending to expand its portfolio early in the day (when its trading moves prices more) and contract its portfolio later in the day (when its trading moves prices less), losing money on its daily round-trip trades to create mark-to-market gains on its large existing book. In the fourteen years since this extraordinary pattern of overnight and intraday returns was first noted in the literature, no plausible alternative explanation has been advanced. The main question remaining is therefore which of the few firms capable of profitably trading in this manner are guilty of having done so. If any of this is news to you, it is because the people you trust to alert you to such problems still haven't told you.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research analyzes stock market data, identifying a pattern of overnight and intraday returns across various global indices, suggesting manipulation by large quantitative trading firms.

Key Results

- A consistent pattern of overnight positive returns and intraday negative returns in major stock indices, except China, over three decades.

- The pattern is attributed to a strategy where quantitative firms expand their portfolios early in the trading day and contract them later, creating mark-to-market gains on large existing books at the expense of daily round-trip trading costs.

- This behavior is evident in individual stocks, with overnight/intraday return patterns consistent with the strategy for both long and short positions.

Significance

The findings suggest a significant, long-term manipulation in global stock markets, which could impact investment decisions and market integrity, highlighting the need for regulatory scrutiny and improved detection mechanisms.

Technical Contribution

The paper introduces a novel explanation for the observed stock market return patterns, attributing them to a sophisticated trading strategy employed by large quantitative firms.

Novelty

This work distinguishes itself by providing a coherent, data-driven explanation for a long-standing market anomaly, bridging the gap between observed patterns and plausible underlying trading strategies.

Limitations

- The research does not identify the specific firms responsible for this manipulation.

- The analysis relies on publicly available data, which may not capture all trading activities, especially off-market trades.

- The proposed explanation, while fitting the observed pattern, remains speculative without concrete evidence of firm involvement.

Future Work

- Investigate further to identify the specific firms employing this strategy.

- Explore additional datasets, including dark pool and OTC data, to capture a more comprehensive view of trading activities.

- Develop and test advanced surveillance tools to detect similar patterns in real-time for regulatory intervention.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWill your Doorbell Camera still recognize you as you grow old

Joseph Lemley, Peter Corcoran, Wang Yao et al.

No citations found for this paper.

Comments (0)