Summary

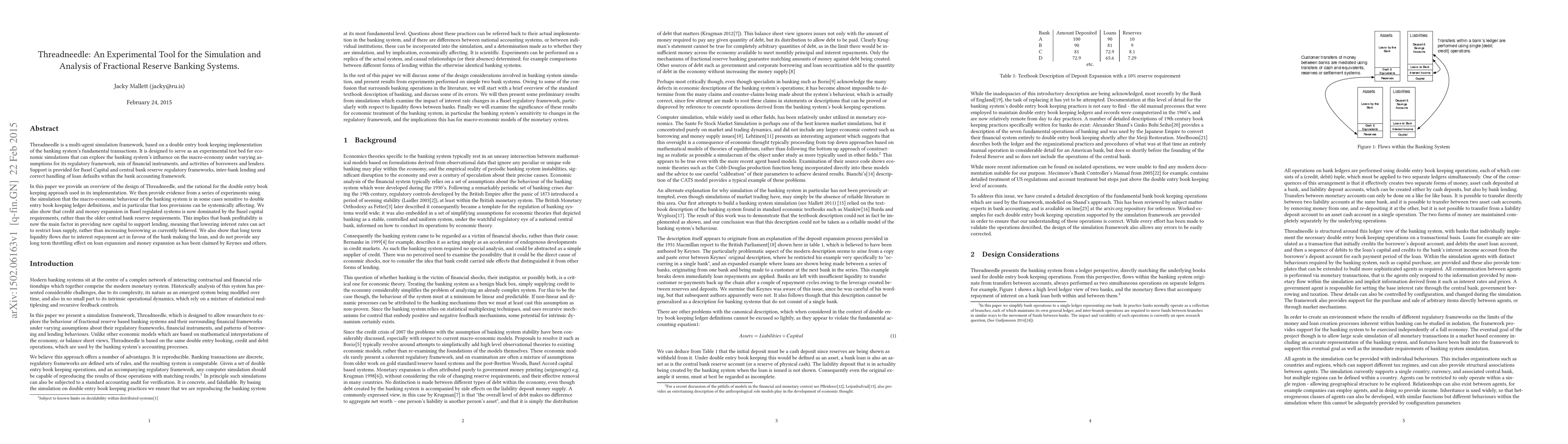

Threadneedle is a multi-agent simulation framework, based on a full double entry book keeping implementation of the banking system's fundamental transactions. It is designed to serve as an experimental test bed for economic simulations that can explore the banking system's influence on the macro-economy under varying assumptions for its regulatory framework, mix of financial instruments, and activities of borrowers and lenders. Support is provided for Basel Capital and central bank reserve regulatory frameworks, inter-bank lending and correct handling of loan defaults within the bank accounting framework. In this paper we provide an overview of the design of Threadneedle, and the rational for the double entry book keeping approach used in its implementation. We then provide evidence from a series of experiments using the simulation that the macro-economic behaviour of the banking system is in some cases sensitive to double entry book keeping ledger definitions, and in particular that loss provisions can be systemically affecting. We also show that credit and money expansion in Basel regulated systems is now dominated by the Basel capital requirements, rather than the older central bank reserve requirements. This implies that bank profitability is now the main factor in providing new capital to support lending, meaning that lowering interest rates can act to restrict loan supply, rather than increasing borrowing as currently believed. We also show that long term liquidity flows due to interest repayment act in favour of the bank making the loan, and do not provide any long term throttling effect on loan expansion and money expansion as has been claimed by Keynes and others.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)