Summary

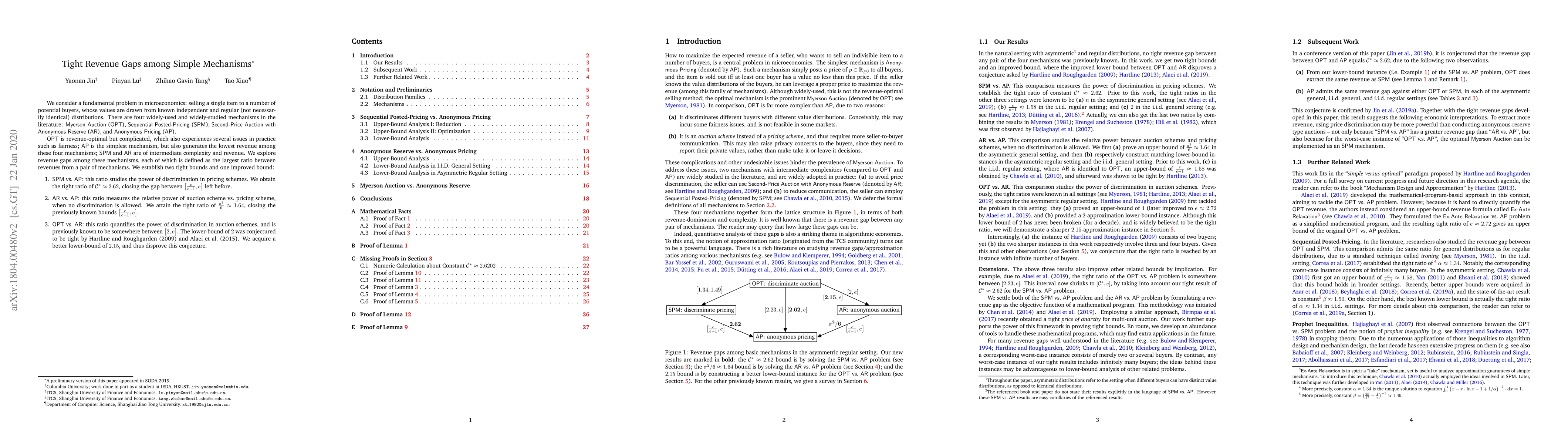

We consider a fundamental problem in microeconomics: selling a single item to a number of potential buyers, whose values are drawn from known independent and regular (not necessarily identical) distributions. There are four widely-used and widely-studied mechanisms in the literature: {\sf Myerson Auction}~({\sf OPT}), {\sf Sequential Posted-Pricing}~({\sf SPM}), {\sf Second-Price Auction with Anonymous Reserve}~({\sf AR}), and {\sf Anonymous Pricing}~({\sf AP}). {\sf OPT} is revenue-optimal but complicated, which also experiences several issues in practice such as fairness; {\sf AP} is the simplest mechanism, but also generates the lowest revenue among these four mechanisms; {\sf SPM} and {\sf AR} are of intermediate complexity and revenue. We explore revenue gaps among these mechanisms, each of which is defined as the largest ratio between revenues from a pair of mechanisms. We establish two tight bounds and one improved bound: 1. {\sf SPM} vs.\ {\sf AP}: this ratio studies the power of discrimination in pricing schemes. We obtain the tight ratio of $\mathcal{C^*} \approx 2.62$, closing the gap between $\big[\frac{e}{e - 1}, e\big]$ left before. 2. {\sf AR} vs.\ {\sf AP}: this ratio measures the relative power of auction scheme vs.\ pricing scheme, when no discrimination is allowed. We attain the tight ratio of $\frac{\pi^2}{6} \approx 1.64$, closing the previously known bounds $\big[\frac{e}{e - 1}, e\big]$. 3. {\sf OPT} vs.\ {\sf AR}: this ratio quantifies the power of discrimination in auction schemes, and is previously known to be somewhere between $\big[2, e\big]$. The lower-bound of $2$ was conjectured to be tight by Hartline and Roughgarden (2009) and Alaei et al.\ (2015). We acquire a better lower-bound of $2.15$, and thus disprove this conjecture.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTight Revenue Gaps among Multi-Unit Mechanisms

Pinyan Lu, Hengjie Zhang, Yaonan Jin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)