Summary

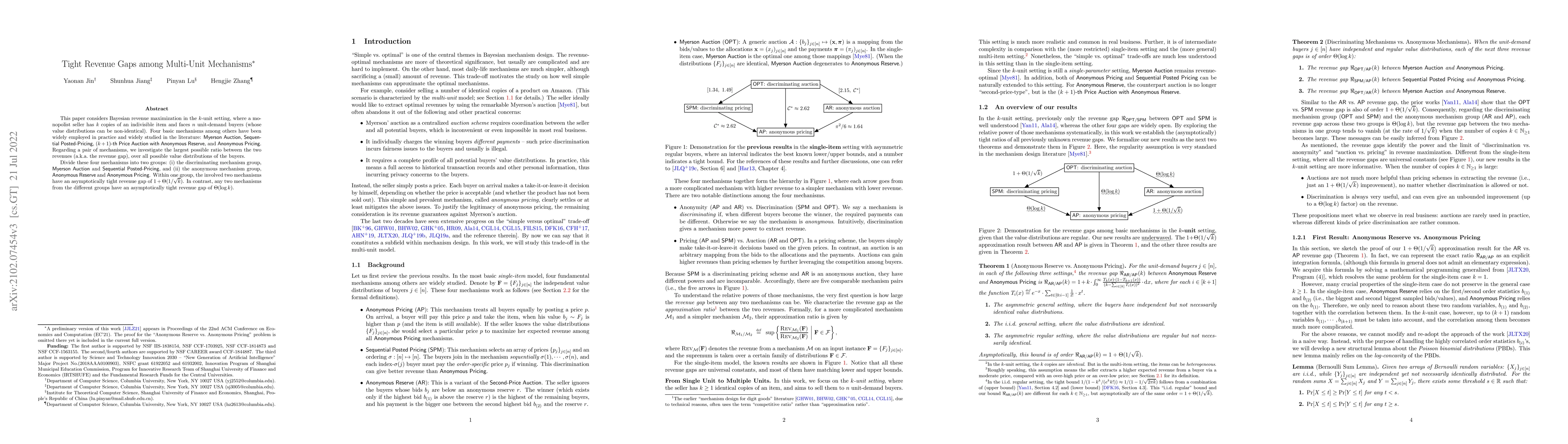

This paper considers Bayesian revenue maximization in the $k$-unit setting, where a monopolist seller has $k$ copies of an indivisible item and faces $n$ unit-demand buyers (whose value distributions can be non-identical). Four basic mechanisms among others have been widely employed in practice and widely studied in the literature: {\sf Myerson Auction}, {\sf Sequential Posted-Pricing}, {\sf $(k + 1)$-th Price Auction with Anonymous Reserve}, and {\sf Anonymous Pricing}. Regarding a pair of mechanisms, we investigate the largest possible ratio between the two revenues (a.k.a.\ the revenue gap), over all possible value distributions of the buyers. Divide these four mechanisms into two groups: (i)~the discriminating mechanism group, {\sf Myerson Auction} and {\sf Sequential Posted-Pricing}, and (ii)~the anonymous mechanism group, {\sf Anonymous Reserve} and {\sf Anonymous Pricing}. Within one group, the involved two mechanisms have an asymptotically tight revenue gap of $1 + \Theta(1 / \sqrt{k})$. In contrast, any two mechanisms from the different groups have an asymptotically tight revenue gap of $\Theta(\log k)$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)