Summary

This note improves the lower and upper bounds of the Black-Scholes implied volatility (IV) in Tehranchi (SIAM J. Financial Math., 7 (2016), p. 893). The proposed tighter bounds are systematically based on the bounds of the option delta. While Tehranchi used the bounds to prove IV asymptotics, we apply the result to the accurate numerical root-finding of IV. We alternatively formulate the Newton-Raphson method on the log price and demonstrate that the iteration always converges rapidly for all price ranges if the new lower bound found in this study is used as an initial guess.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

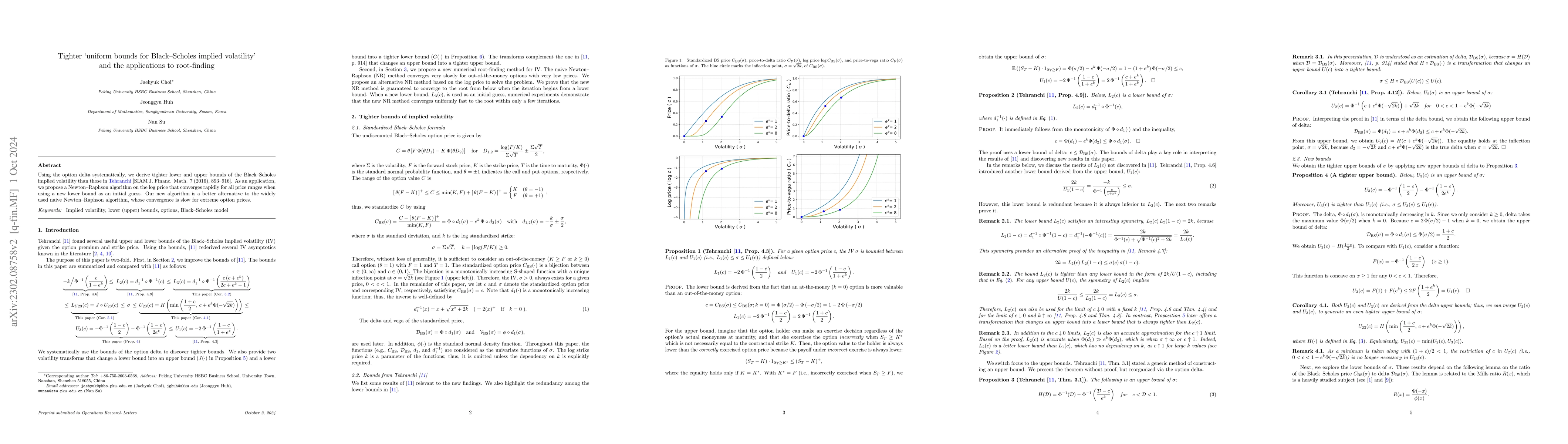

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSmile asymptotic for Bachelier Implied Volatility

Roberto Baviera, Michele Domenico Massaria

No citations found for this paper.

Comments (0)